Loading

Get Aoc E 212 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Aoc E 212 online

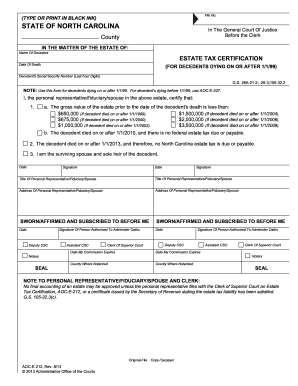

Filling out the Aoc E 212 form can be a straightforward process when approached step by step. This guide is designed to help users accurately complete the estate tax certification to ensure compliance with North Carolina regulations.

Follow the steps to fill out the form effectively.

- Click the ‘Get Form’ button to access the Aoc E 212 form and open it in your preferred online editor.

- Begin by entering the file number at the top of the form, as provided in your estate documents.

- Fill in the state section designating 'North Carolina' to confirm the state jurisdiction.

- In the matter of the estate section, enter the name of the decedent exactly as it appears on official documents.

- Input the date of death in the designated field, using the format MM/DD/YYYY.

- For the decedent's social security number, provide the last four digits only, ensuring privacy is maintained.

- In Section 1, confirm the gross value of the estate prior to the decedent's death, selecting the correct threshold based on the date of death.

- Tick the appropriate box in Section 2 to assert that no North Carolina estate tax is due if the decedent died on or after 1/1/2013.

- Sign and date the form as the personal representative, fiduciary, or spouse. Ensure the title and address fields are completed accurately.

- Have the form notarized by a person authorized to administer oaths, then sign and date the notary section.

- Finally, save your changes to the form, download a copy for your records, and share or print it to submit as required.

Complete your Aoc E 212 form online today to ensure timely compliance with estate tax certification.

NC AoC stands for North Carolina Administrative Office of the Courts. This organization oversees the administrative functions of the court system in North Carolina, including estate and probate matters. Familiarizing yourself with the resources provided by the NC AoC can assist in navigating legal forms like the AOC E 212.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.