Loading

Get Iht409

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Iht409 online

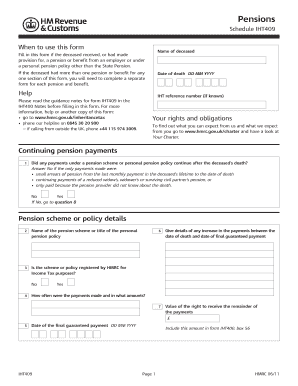

The Iht409 form is essential for reporting pensions and benefits associated with a deceased individual’s estate. This guide aims to assist users in completing the form online with clarity and precision, regardless of their legal experience.

Follow the steps to effectively complete the Iht409 form online.

- Click the ‘Get Form’ button to access the Iht409 form and open it in the editor.

- Fill in the name of the deceased in the designated field.

- Enter the date of death in the format DD MM YYYY.

- Provide the IHT reference number if known.

- Indicate whether any pension scheme payments continued after the deceased’s death by selecting Yes or No.

- If payments continued, enter the name of the pension scheme or title of the personal pension policy in the appropriate field.

- Confirm if the scheme is registered by HMRC for Income Tax purposes.

- Provide details of any increase in payments between the date of death and the final guaranteed payment.

- State the amount and frequency of payments made.

- If applicable, answer questions regarding lump sum payments under the pension scheme, including whether it was at the trustees’ discretion and the identity of the recipient.

- Complete sections regarding any transfers or changes made to pension benefits within two years prior to death.

- Indicate any contributions made to the pension scheme by the deceased or their employer within two years before death.

- Fill out details related to alternatively secured pension funds, if applicable, based on the date of death.

- If there are any dependant’s pension funds, provide the relevant details as required.

- Review all entered information for accuracy before finalizing.

- Save changes, download, print, or share the completed form as needed.

Complete the Iht409 and other documents online for a smoother process.

One common loophole for Inheritance Tax involves gifting assets before death, as gifts made more than seven years prior are generally exempt from tax. You may also set up trusts to safeguard your estate from excessive tax burdens. Delve into IHT409 for comprehensive insights that help you navigate these strategies legally and effectively.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.