Get Taxpayer Registration Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Taxpayer Registration Form online

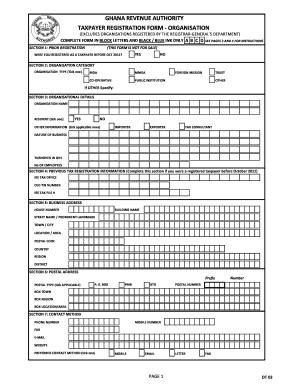

Filling out the Taxpayer Registration Form online is an essential step for organizations seeking to register for tax purposes. This guide provides clear, step-by-step instructions to help users complete the form accurately.

Follow the steps to complete your Taxpayer Registration Form online.

- Click ‘Get Form’ button to obtain the form and open it in your editing tool.

- In Section 1, indicate if you were registered as a taxpayer before October 2011 by ticking 'Yes' or 'No'.

- Move to Section 2, select your organization type by ticking one of the options provided such as MDA, MMDA, or Co-operative. If your organization type falls under 'Other', please specify in the provided space.

- Fill in Section 3 with your organization’s details. Enter the organization name, tick whether it is a resident organization, and provide any applicable information regarding its activities, business nature, turnover, and number of employees.

- If applicable, complete Section 4 by entering the prior IRS Tax Office, old Taxpayer Identification Number (TIN), and IRS Tax File number.

- Section 5 requires you to provide your business address, including house number, building name, street name, town or city, postal code, and region.

- Complete Section 6 with your postal address details, selecting the postal type and entering the corresponding postal number.

- In Section 7, list your contact information including phone number, mobile number, fax, email, and website, then select your preferred contact method.

- Section 8 allows you to provide details about any branches. Include the name, location, and address of each branch.

- In Section 9, provide necessary details of any associated businesses, including their TIN, name, and address.

- Section 10 is for providing information about trustees or officers within your organization. Include their TIN and name.

- Finally, in Section 11, declare that the provided information is accurate. Sign, date, and include your name and position.

- After reviewing the completed form, proceed to save your changes, and you may download, print, or share the form as needed.

Start filling out your Taxpayer Registration Form online today to ensure timely and accurate submission.

If you are overseas and wish to apply for a Taxpayer Registration Number (TRN) in Jamaica, you can do so by requesting the application form online. Complete the form and send it along with the necessary identification documents to the Jamaican tax authorities via email or postal service. Be aware that the process may take longer for international applications. Utilizing services like USLegalForms can also guide you through the international application steps to ensure a successful submission.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.