Loading

Get Oregon Form 243 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Oregon Form 243 online

Filling out the Oregon Form 243 online can seem daunting, especially during a difficult time. This guide provides clear, step-by-step instructions to help you smoothly navigate the process and accurately complete the claim for a refund due to a deceased individual.

Follow the steps to successfully fill out the Oregon Form 243 online.

- Click the ‘Get Form’ button to obtain the document and open it in your preferred form editor.

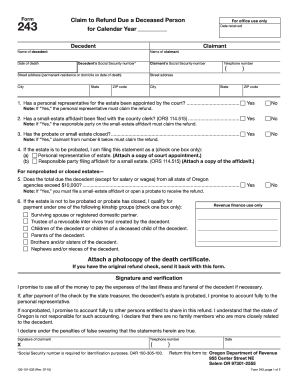

- Begin by filling in the decedent's name and date of death in the designated fields at the top of the form.

- Input the name of the claimant, along with both the decedent's and the claimant's Social Security numbers in the appropriate sections.

- Provide the street address of the decedent's permanent residence at the time of death, along with the city, state, and ZIP code.

- Next, indicate your telephone number in the specified field.

- Respond to questions 1 through 3 regarding the appointment of a personal representative, filing of a small-estate affidavit, and status of probate or small estate. Select either 'Yes' or 'No' for each question.

- If the estate is to be probated, select the appropriate status under question 4, either as a personal representative or responsible party filing affidavit for a small estate. Ensure to attach the necessary documentation.

- For nonprobated or closed estates, answer question 5 regarding the total amount due from state agencies, selecting 'Yes' or 'No.'

- In question 6, indicate your relationship to the decedent by selecting one of the kinship groups provided.

- Make sure to attach a photocopy of the death certificate to the form as required.

- Complete the signature and verification section by signing and dating the form, confirming your promises regarding the funds.

- Finally, save your changes, download, and/or print the form as needed. Then, you can share the completed form or return it to the Oregon Department of Revenue as instructed.

Complete your documents online today and ensure that claims are processed efficiently.

Yes, you can e-file your Oregon tax extension using approved tax software or services. This method is fast and often ensures accurate, timely submissions. Make sure to keep confirmation of your e-filing for your records. E-filing simplifies the process and reduces the likelihood of mistakes, making it a preferred option.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.