Loading

Get Gst34

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Gst34 online

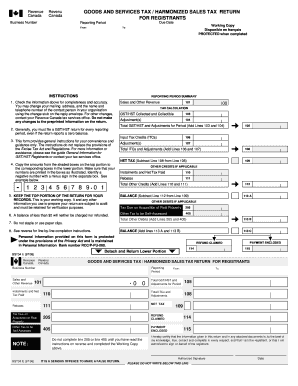

Filling out the Gst34 form is a crucial step for businesses registered for the Goods and Services Tax and Harmonized Sales Tax. This guide will provide a clear, step-by-step approach to completing the form effectively and efficiently online.

Follow the steps to complete the Gst34 form successfully.

- Click ‘Get Form’ button to acquire the Gst34 form and open it in your preferred online editor.

- Verify the reporting period information. Input the start and end dates for the period you are reporting on in the designated fields.

- Check for completeness and accuracy in the business number and contact information. Ensure that any necessary updates are made using the provided change stub.

- In the Sales and Other Revenue section, report the total sales and any revenue generated within the reporting period.

- In the Tax Calculation section, indicate the amount of GST/HST collected and collectible. Make necessary adjustments in the provided fields.

- Calculate total GST/HST and adjustments by adding your amounts from the previous lines and record it accordingly.

- Proceed to the Input Tax Credits (ITCs) section. Report any ITCs you are claiming, including adjustments, and calculate the total for this section.

- Determine the net tax by subtracting total ITCs and adjustments from the total GST/HST and adjustments.

- If applicable, fill out the Other Credits section with any relevant instalments or rebates.

- Divide the bottom portion of the form, keeping the top portion for your records. Ensure all information is accurate and double-check your calculations.

- Complete the certification statement by signing and dating the form. Ensure you are authorized to sign on behalf of the registrant.

- Finally, save your completed form, and choose whether to download, print, or share it as required.

Start filling out your Gst34 form online today to ensure timely compliance and reporting.

The amount of CGST varies based on the applicable rate determined by the type of goods or services provided. Typically, CGST is half of the total GST rate applicable. Therefore, it's important to stay updated with current tax laws to ensure your GST34 filings reflect accurate amounts.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.