Loading

Get Form Vat 605

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form Vat 605 online

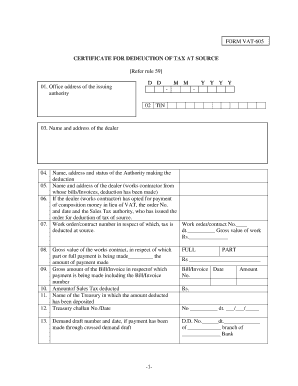

Form Vat 605 is essential for certifying the deduction of tax at source. Filling it out correctly is crucial for compliance and transparency in tax matters. This guide provides clear, step-by-step instructions to help you complete the form online with ease.

Follow the steps to fill out the Form Vat 605 efficiently.

- Click the ‘Get Form’ button to access the Form Vat 605 and open it in your preferred online editor.

- Enter the office address of the issuing authority in the designated field.

- Provide your Taxpayer Identification Number (TIN) in the appropriate section.

- Fill in the name and address of the dealer. Ensure accuracy in spelling and details.

- Input the name, address, and status of the authority that is making the deduction.

- If applicable, state whether the dealer (work contractor) has opted for payment of composition money in lieu of VAT. Include the corresponding order number, date, and the sales tax authority issuing the order.

- Record the work order or contract number related to the source tax deduction.

- Indicate the gross value of the works contract concerning which part or full payment has been made.

- Document the gross amount of the bill or invoice, including the corresponding bill or invoice number.

- Specify the amount of sales tax deducted from the payment.

- Mention the name of the treasury where the deducted amount has been deposited.

- Fill in the treasury challan number and date to confirm the deposit.

- If payment has been made through a crossed demand draft, enter the demand draft number and date, as well as the details of the issuing bank branch.

- If consolidated payment is applicable, attach a statement showing the details of all works contractors associated with the transaction.

- Complete the declaration section, certifying the total amount deducted. Sign and date where indicated.

- Review all entries for accuracy, then save your changes, download, print your completed form, and share it as necessary.

Complete your Form Vat 605 online today for a streamlined filing process.

Related links form

Doing a VAT return involves keeping track of your transactions, calculating the VAT due, and filling out Form Vat 605 accurately. After preparing the form, submit it to the appropriate tax authority by the deadline. Consider using uslegalforms for step-by-step assistance and tools to ensure your return is completed correctly.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.