Loading

Get Freddie Mac Form 90 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Freddie Mac Form 90 online

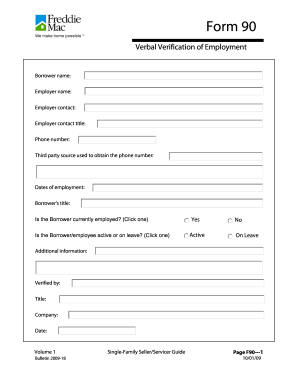

Filling out the Freddie Mac Form 90 online is a straightforward process that allows users to verify employment details efficiently. This guide will walk you through each component of the form, ensuring you understand how to fill it out correctly.

Follow the steps to complete the form accurately.

- Click 'Get Form' button to obtain the form and open it in the digital platform.

- Enter the borrower's name in the designated field. This should be the full legal name of the individual whose employment is being verified.

- In the employer name section, input the name of the organization where the borrower is employed.

- Fill in the employer contact field with the name of the representative who can confirm the borrower's employment status.

- Provide the employer's contact title to ensure clarity regarding the position of the individual verifying the employment.

- Enter the phone number of the employer contact. This information should be accurate to facilitate any follow-up inquiries.

- Specify the third-party source used to obtain the phone number, offering a reference for the contact information provided.

- Fill out the dates of employment for the borrower. This should include the start date and, if applicable, the end date of employment.

- Input the borrower's title as it is recognized within their workplace.

- Indicate whether the borrower is currently employed by selecting 'Yes' or 'No.'

- Clarify the borrower's employment status by choosing between 'Active' or 'On Leave.'

- Provide any additional information that may be relevant to the verification of employment in the designated field.

- Complete the 'Verified by' section with the signature of the individual confirming the employment information.

- Fill in the title and company of the verifier to ensure proper authorization.

- Enter the date when the verification was completed.

- Once all fields are completed, review the form for accuracy before saving your changes, downloading, printing, or sharing the document as needed.

Start filling out your Freddie Mac Form 90 online today for efficient employment verification.

Freddie Mac requires at least two tradelines for borrowers to effectively demonstrate their credit history and repayment capability. These accounts may come from credit cards, loans, or other credit sources. Maintaining good standing in these accounts is vital for a successful application. For thorough guidance, look to Freddie Mac Form 90, which will help clarify your obligations regarding tradelines.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.