Loading

Get 1040 A

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 1040 A online

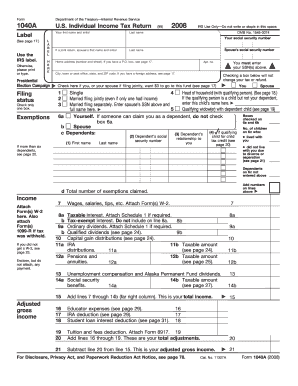

Filing your taxes can be a straightforward process with the right guidance. This guide offers clear and detailed instructions on how to fill out the 1040 A form online, ensuring you understand each step along the way.

Follow the steps to successfully complete the 1040 A form.

- Click ‘Get Form’ button to obtain the form and open it in the digital editor.

- Begin by entering your first name and middle initial, last name, and social security number in the designated fields. If you are filing jointly, include your spouse's first name, middle initial, last name, and their social security number as well.

- Next, provide your home address, including the street number and name, apartment number (if applicable), city or town, state, and ZIP code. If you have a foreign address, consult the relevant section.

- Indicate whether you wish to contribute $3 to the Presidential Election Campaign by checking the appropriate box, if desired.

- Select your filing status by checking one of the boxes provided. Options include single, head of household, married filing jointly, married filing separately, and qualifying widow(er).

- Complete the exemptions section by entering your social security number(s) and indicating the number of dependents you are claiming. Each dependent requires their first name, last name, social security number, and relationship to you.

- In the income section, attach your W-2 forms and any 1099-R forms that apply. Input your wages, salaries, tips, and other relevant income figures in the appropriate fields.

- Calculate and enter your adjusted gross income by adding total income and making necessary deductions, which are specified in the following lines.

- Proceed to the tax, credits, and payments sections. Here, enter details regarding your standard deduction, taxes owed, and payments made through withholding or estimated taxes.

- If you have any additional credits or tax deductions, be sure to complete those sections accurately, including any earned income credit or specific deductions applicable to your situation.

- Finally, review the entire form for accuracy, then choose to save your changes, download the document, print it, or share it as necessary.

Complete your tax documents online today for a quick and efficient filing experience.

Form 1040 A was used by individuals who preferred a more straightforward tax filing process without the complexity of itemizing deductions. However, as this form is no longer available, taxpayers now utilize Form 1040 for a wider range of tax situations. If you are unsure about how to proceed, explore resources on the US Legal Forms platform for guidance.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.