Loading

Get Nr5 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Nr5 Form online

Filling out the Nr5 Form online can be a straightforward process if you follow the necessary steps. This guide will provide you with clear and concise instructions to ensure you accurately complete the form and take full advantage of tax benefits available to non-residents of Canada.

Follow the steps to complete the Nr5 Form online effectively.

- Click ‘Get Form’ button to obtain the form and open it in your editor.

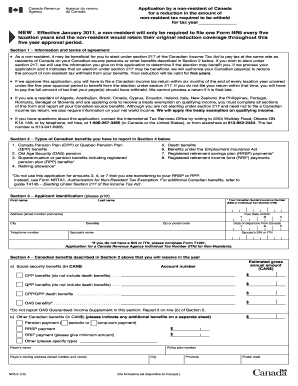

- In Section 1, provide your information and agree to the terms. This section details the benefits of electing under section 217 and the requirements for filing a Canadian income tax return.

- Fill out Section 2 by indicating the types of Canadian benefits you are receiving. Detail each benefit and ensure all applicable fields are completed.

- Complete Section 3 for applicant identification. Include your first name, last name, Canadian Social Insurance Number (SIN) or Individual Tax Number (ITN), and contact information.

- In Section 5, provide information about your net world income in Canadian dollars. This includes any Canadian-source income and income from outside Canada, as well as responses to questions regarding supporting dependents.

- After completing each section, review all entered information for accuracy. Ensure you have filled out all necessary fields and provided supporting documents as required.

Start filling out the Nr5 Form online today to ensure you receive the tax reductions you may qualify for.

To notify the CRA about your move out of Canada, you can complete the NR5 Form and submit it along with your tax return. This form helps declare your non-resident status effectively. Keeping the CRA informed ensures you meet any tax obligations and avoids confusion in the future.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.