Loading

Get Examples Of Completed Iht205 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Examples Of Completed Iht205 online

Filling out the Examples Of Completed Iht205 form can seem daunting, but with clear guidance, you can navigate each section confidently. This comprehensive guide provides detailed instructions to assist you in completing the form accurately.

Follow the steps to effectively complete the form.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

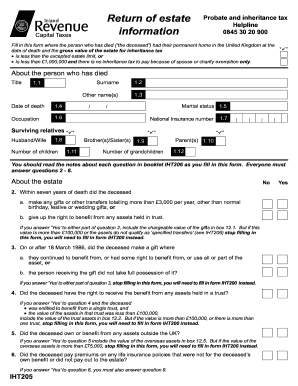

- Begin by filling out the section about the person who has died. Input their title, surname, other names, date of death, occupation, marital status, National Insurance number, and details about surviving relatives such as spouse, children, and siblings.

- In the ‘About the Estate’ section, answer all questions from 2 to 8. Carefully indicate whether the deceased made gifts or had assets held in trusts that may affect taxation. Be aware that if you answer 'Yes' to certain questions, you may need to shift to the IHT200 form instead.

- For the deceased's own assets including joint assets, complete sections 11 and 12. List all assets' gross values without deductions. If uncertain, provide your best estimate and tick the box indicating an estimate.

- List debts of the estate in section 13, including funeral expenses and any other liabilities. Total the debts to determine the net estate.

- Review the exemptions applicable to the estate in section 15. Deduct any applicable exemptions and ensure you provide details about qualifying assets.

- Finally, verify all entries for accuracy. Once completed, you can save changes, download, print, or share the filled form as needed.

Start your online document completion journey now!

The net qualifying value of an estate is the sum that remains after deducting debts and liabilities from the gross estate value. This value helps determine if the estate is liable for inheritance tax. Having a clear understanding of this value is crucial for effective estate planning. Referencing Examples Of Completed Iht205 can aid in grasping this important aspect of estate management.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.