Loading

Get Form 4757 Missouri 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

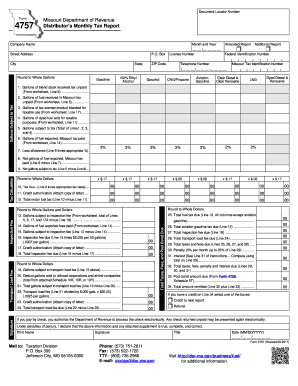

How to fill out the Form 4757 Missouri online

This guide aims to provide clear and concise instructions for users on how to effectively complete the Form 4757 Missouri online. By following these steps, you will ensure that your tax report is accurate and submitted correctly.

Follow the steps to fill out Form 4757 Missouri online

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your company name, month, and year of the report at the top of the form. If this is an amended report, check the box provided.

- Fill in the street address, P.O. Box, license number, federal ID number, city, state, zip code, and telephone number.

- Locate the sections for different fuel types (gasoline, ethanol, etc.) and fill in the gallons subject to tax, rounding to whole gallons as specified.

- Complete the tax calculation section based on the gallons reported, ensuring accurate multiplication with the applicable tax rates.

- If you have any credits (from previous reports), enter them in the designated section and attach required letters for authorization.

- Complete the sections for inspection fees and transport load fees, rounding as necessary and ensuring accurate calculations based on the provided worksheets.

- Carefully review all entered information for accuracy and completeness.

- Save your changes. You may also download, print, or share the form as needed before submission.

Encourage others to complete their documents online for accurate and efficient filing.

The rules for termination in Missouri vary based on the type of entity. Generally, you must settle debts, notify stakeholders, and file pertinent documents with the state. A helpful resource, such as Form 4757 Missouri, provides clarity and helps ensure that you comply with all legal requirements during the termination process.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.