Loading

Get Ap 133 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ap 133 online

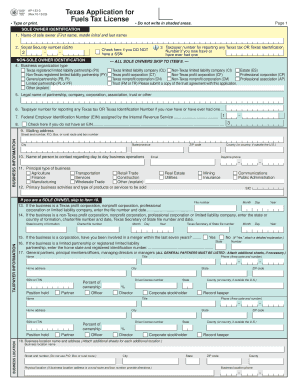

The Ap 133 form is a vital document required for obtaining a fuels tax license in Texas. Completing this form accurately ensures compliance with Texas Motor Fuels Tax Law and facilitates smooth processing of your application.

Follow the steps to fill out the Ap 133 online.

- Press the ‘Get Form’ button to access the form and open it in your preferred online editing tool.

- Begin filling out the form by entering your first name, middle initial, and last name in Item 1 if you are a sole owner. Skip to Item 9 if you are not.

- In Item 4, specify the type of business organization you belong to, such as a corporation, partnership, or other organization. Provide the legal name in Item 5.

- Input your Texas Identification Number or Texas taxpayer number in Item 6, if applicable. If not, leave it blank.

- Enter your federal Employer Identification Number in Item 7. If you do not have an EIN, indicate this in the provided checkbox.

- Provide the mailing address in Item 9 where you wish to receive correspondence from the Comptroller of Public Accounts.

- For partnerships or corporations, complete Items 13 and 14 by entering the file number assigned by the Secretary of State and date of formation.

- In Item 18, clearly state the actual location of your business with detailed directions, avoiding use of P.O. Box or rural routes.

- In Item 20, check all applicable blocks for the type of fuels tax licenses you are applying for. Make sure to provide accurate fuel type specifications.

- After completing all sections, review your entries for accuracy, then save changes, download, print, or share the completed form as needed.

Complete your Ap 133 form online today to ensure timely processing of your fuels tax license application.

The fuel tax for Texas includes various rates applied to different types of fuels sold in the state. This tax is crucial for funding state services and infrastructure. Businesses must stay compliant with tax laws to avoid penalties and ensure smooth operations. To better navigate these tax implications, including those related to Ap 133, leverage the support of USLegalForms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.