Loading

Get Dr1191

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Dr1191 online

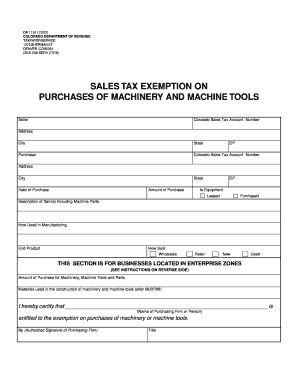

The Dr1191 form is essential for claiming a sales tax exemption on machinery and machine tools in Colorado. This guide will provide clear instructions to help you complete the form accurately and efficiently.

Follow the steps to complete the Dr1191 form online.

- Click the ‘Get Form’ button to access the Dr1191 online. Ensure the form opens correctly for you to proceed.

- Fill in the seller's information, including the Colorado sales tax account number, address, city, state, and ZIP code. Ensure that all details are accurate for processing.

- Provide the purchaser's details similarly, including their Colorado sales tax account number, address, city, state, and ZIP code.

- Enter the date of purchase and the total amount of the purchase in the respective fields. This information is crucial for determining the eligibility of the exemption.

- Indicate whether the equipment is leased or purchased by selecting the appropriate option.

- In the description section, describe the item(s) clearly, including any machine parts. Specify how the machinery will be used in manufacturing and the end product.

- Select how the item will be sold, choosing either wholesale or retail, and specify if it is new or used.

- For businesses located in enterprise zones, complete the relevant section about the amount of purchase for machinery and machine tools, specifying any materials used in construction.

- Certify the form by entering the name of the purchasing firm or person, followed by the authorized signature and title of the signer.

- Once all fields are filled out accurately, save the changes. You can then download, print, or share the completed Dr1191 form as needed.

Complete your Dr1191 form online today to take advantage of the sales tax exemption.

Yes, Colorado does accept out of state resale certificates, provided they comply with Colorado’s tax regulations. Businesses looking to utilize an out of state resale certificate should ensure it meets the criteria stipulated by state law. For more detailed information on this topic, Dr1191 offers helpful insights and assistance in navigating these regulations.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.