Get Tangible Net Benefit Form Massachusetts 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Tangible Net Benefit Form Massachusetts online

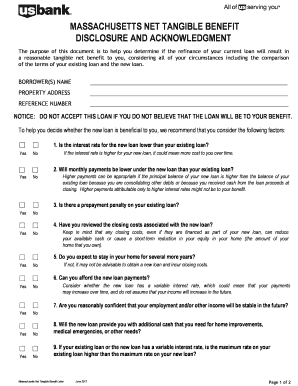

This guide provides clear and comprehensive instructions on completing the Tangible Net Benefit Form in Massachusetts. By following the steps outlined below, you can effectively assess whether refinancing your loan is beneficial based on your specific circumstances.

Follow the steps to accurately complete the form online.

- Press the ‘Get Form’ button to obtain the Tangible Net Benefit Form and open it in your chosen document viewer.

- Begin by entering the names of all borrowers in the designated field at the top of the form. Ensure that the names match those on your current loan documents.

- Next, provide the property address where the loan is secured. This should be the full legal address to avoid any discrepancies.

- In the reference number field, input any loan or transaction reference number if applicable. This is often found in your original loan documentation.

- Carefully read through the notice that advises against accepting the loan if you do not believe it will provide a benefit. This serves as a critical reminder of your rights.

- For each subsequent question regarding the new loan's interest rate, monthly payments, prepayment penalties, and closing costs, respond truthfully with 'Yes' or 'No'. Make sure to consider your financial situation for each question.

- Take time to review your answers carefully, particularly around your financial stability and expectations for stay in your home. Being honest here is vital to safeguard your interests.

- After completing all the questions, you will need to sign the form in the designated areas. Both borrowers must provide their signatures and the date.

- Once you have filled out and signed the Tangible Net Benefit Form, you can save your changes, download the document, print it for your records, or share it as needed.

Take action now and complete your Tangible Net Benefit Form online for a smoother refinancing process.

The net tangible benefits of the Federal Housing Administration (FHA) include improved access to affordable housing and reduced upfront costs for borrowers. By offering flexibility in qualification requirements, FHA loans make it easier for various borrowers to secure financing. When you complete the Tangible Net Benefit Form Massachusetts, it becomes clear how FHA loans can provide significant savings over time, thus helping families achieve homeownership.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.