Get Financial Advisor Client Questionnaire

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Financial Advisor Client Questionnaire online

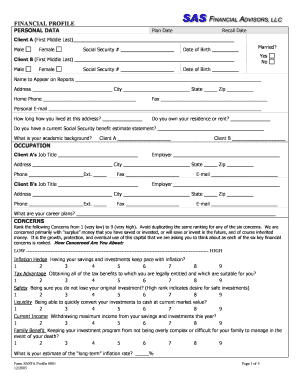

Completing the Financial Advisor Client Questionnaire is an important step in establishing a strong financial plan tailored to your needs. This online guide will walk you through each section of the form, providing clear instructions to help you fill it out accurately and efficiently.

Follow the steps to effectively complete the questionnaire.

- Click ‘Get Form’ button to obtain the questionnaire and open it for completion.

- Begin by filling out the personal data section. Provide the required information for Client A and Client B, including names, social security numbers, and dates of birth. Make sure to indicate marital status and primary contact details.

- In the occupation section, list job titles, employers, and contact information for both clients. Include career plans to provide insights into financial goals.

- Move to the concerns section where you will rank specific financial concerns from 1 (very low) to 9 (very high). Ensure that each concern is assigned a unique ranking to express your priorities accurately.

- Next, document your advisors. Identify types of advisors you consult, their names, and contact details to provide context for your financial decision-making process.

- In the dependents section, enter details of any dependents, their birthdays, and whether they have special needs. You will also indicate any financial obligations related to them.

- Complete the education goals section. Outline the educational aspirations for your dependents, specifying schools, anticipated costs, and timelines for funding.

- Provide a comprehensive overview of income and expenses for both Client A and Client B. Gather monthly and annual figures from various sources, ensuring all income streams and expenditures are accounted for.

- Finally, review your assets and liabilities, and provide the relevant details such as market values and rates of return. Make sure to also document any insurance policies and associated details.

- Once all sections are completed, save your changes. You may choose to download, print, or share the completed questionnaire as needed.

Start filling out the Financial Advisor Client Questionnaire online to take the first step toward managing your financial future.

The 3 C's of selecting a financial advisor are competence, character, and chemistry. You want to ensure that your adviser has the necessary skills, shares your values, and fosters a comfortable working relationship. A Financial Advisor Client Questionnaire can facilitate discussions about these important criteria, helping you make the best choice.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.