Loading

Get W9 Puerto Rico

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the W9 Puerto Rico online

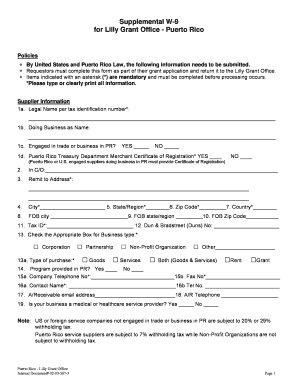

Filling out the W9 Puerto Rico form is an essential step for individuals and organizations applying for grants through the Lilly Grant Office. This guide will provide you with clear instructions on completing each section of the form accurately and efficiently.

Follow the steps to complete your W9 Puerto Rico form online

- Click ‘Get Form’ button to access the W9 Puerto Rico form and open it for editing.

- Enter your legal name as it appears on your tax identification number in the first field. Make sure to include any suffixes such as Jr. or Sr. if applicable.

- In the second field, provide your 'Doing Business As' name if it differs from your legal name. If there is no DBA, you may leave this field blank.

- Indicate whether you are engaged in trade or business in Puerto Rico by checking the appropriate box (YES or NO).

- If applicable, check the box confirming you possess a Puerto Rico Treasury Department Merchant Certificate of Registration.

- Fill out the 'In C/O' section, specifying any additional contact person for correspondence.

- Provide your complete remit to address. This includes street address, city, state/region, zip code, and country.

- Enter your Tax Identification Number in the designated field. This is required for tax reporting purposes.

- Select the appropriate box that describes your business type. You may also indicate the type of purchases your entity engages in, such as goods or services.

- Indicate whether the program is provided in Puerto Rico by choosing YES or NO.

- Complete the contact information fields, including your company telephone number, fax number, and a contact name for further communication.

- Confirm whether your business is a medical or healthcare service provider by checking the corresponding box.

- Review the certification statement and provide your authorized signature, printed name, title, and date.

- Finalize your document by saving your changes and choosing to download, print, or share the completed form as necessary.

Complete your W9 Puerto Rico form online today for your grant application.

The W9 form is used in the U.S. to request taxpayer information from individuals and businesses. Essentially, it provides the requester (such as an employer or client) with an individual's name and Tax Identification Number. For individuals in Puerto Rico, the W9 Puerto Rico serves a similar purpose, ensuring tax compliance with American and local requirements.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.