Loading

Get Tc 721a

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Tc 721a online

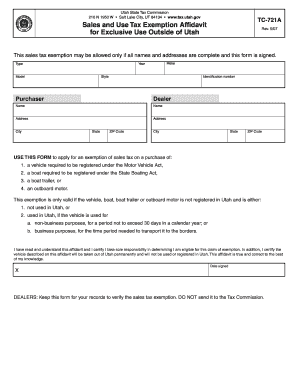

The Tc 721a, or sales and use tax exemption affidavit for exclusive use outside of Utah, is an essential document for individuals seeking tax exemptions on specific purchases. This guide will provide you with clear, step-by-step instructions on how to effectively complete the form online, ensuring all necessary details are correctly filled out.

Follow the steps to successfully complete the Tc 721a online

- Press the ‘Get Form’ button to access the Tc 721a document and open it in your preferred editor.

- Begin filling out the form by entering the type of vehicle, boat, or motor you are applying for exemption on, making sure to include the make, year, model, style, and identification number.

- Next, provide your information in the 'Purchaser' section. Include your full name, address, city, state, and ZIP code clearly.

- In the 'Dealer' section, fill out the dealer's name, address, city, state, and ZIP code, if applicable.

- Carefully read the exemption criteria listed on the form to ensure your purchase qualifies for the exemption.

- Sign and date the affidavit, certifying your understanding and responsibility regarding the accuracy of the information provided.

- Once all fields are filled out and verified, finalize your document by saving the changes. You can then download, print, or share the completed Tc 721a for your records.

Complete your documents online today!

You can obtain a tax ID number in Utah by applying online through the Utah State Tax Commission's website or visiting their office. The application process is straightforward and requires basic information about your business. Once you have your tax ID number, you can begin leveraging the benefits under Tc 721a.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.