Loading

Get Tax File Number Declaration Form - Ato 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Tax File Number Declaration Form - ATO online

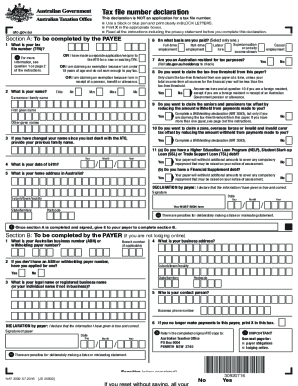

Filling out the Tax File Number Declaration Form is an essential step for individuals looking to ensure that the correct amount of tax is withheld from their income. This comprehensive guide will walk you through each section of the form to help you complete it accurately and efficiently.

Follow the steps to complete your Tax File Number Declaration Form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In Section A, provide your tax file number (TFN) in Question 1. Only share your TFN with your employer after starting work to minimize the risk of administrative errors.

- Next, complete your personal information. Enter your name, date of birth, and home address in Australia as instructed.

- For Question 6, specify the basis on which you are paid, selecting from the provided options like full-time employment or casual employment.

- In Questions 7 and 8, answer whether you are an Australian resident for tax purposes and if you wish to claim the tax-free threshold from this payer.

- Progress through Questions 9 to 11 regarding tax offsets, ensuring you only claim with one payer at a time.

- Once you have filled out all sections of Section A, sign and date the declaration at the bottom.

- Submit the completed declaration to your payer, who will fill out Section B.

- Finally, save your changes, and if necessary, download or print the completed form for your records.

Start filling out your Tax File Number Declaration Form online today to ensure accurate tax withholding!

Related links form

In Australia, the TFN consists of nine digits, which may appear in groups separated by spaces. The format usually looks like this: 123 456 789. Ensuring you present your TFN correctly on the Tax File Number Declaration Form - ATO is vital. This helps the ATO and your employer process your tax details accurately.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.