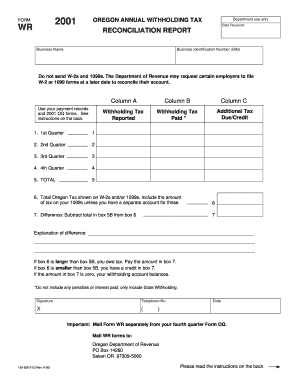

Get Oregon Annual Withholding Tax Reconciliation Report 2019 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign Oregon Annual Withholding Tax Reconciliation Report 2019 online

How to fill out and sign Oregon Annual Withholding Tax Reconciliation Report 2019 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Discover all the advantages of submitting and finalizing forms online. Utilizing our solution to complete the Oregon Annual Withholding Tax Reconciliation Report 2019 will only take a few minutes. We make this achievable by providing you with access to our comprehensive editor that is capable of modifying/correcting a document's original text, adding special fields, and affixing your signature.

Complete the Oregon Annual Withholding Tax Reconciliation Report 2019 in just a few clicks by following the steps below:

Submit the new Oregon Annual Withholding Tax Reconciliation Report 2019 electronically once you have finished filling it out. Your data is securely protected, as we follow the latest security protocols. Join countless satisfied clients who are already completing legal documents from the comfort of their homes.

- Locate the document template you need from the collection of legal form samples.

- Click the Get form button to access it and begin editing.

- Fill in the necessary fields (they are highlighted in yellow).

- The Signature Wizard will enable you to add your electronic signature right after you have finished entering the information.

- Input the date.

- Review the entire document to confirm that you have completed all the information and no revisions are necessary.

- Click Done and save the completed document to your device.

How to Revise Get Oregon Annual Withholding Tax Reconciliation Report 2019 2020: Personalize Documents Online

Your swiftly adjustable and customizable Get Oregon Annual Withholding Tax Reconciliation Report 2019 2020 template is readily accessible. Take advantage of our repository with a built-in online editor.

Do you procrastinate finishing Get Oregon Annual Withholding Tax Reconciliation Report 2019 2020 because you simply don't know how to begin and how to proceed? We recognize your sentiments and offer an outstanding tool for you that has nothing to do with conquering your delays!

Our online collection of ready-to-change templates allows you to browse and select from thousands of fillable documents designed for various purposes and situations. However, acquiring the document is merely the beginning. We provide you with all the necessary tools to complete, sign, and modify the form of your choice without leaving our platform.

All you need to do is open the form in the editor. Review the wording of Get Oregon Annual Withholding Tax Reconciliation Report 2019 2020 and verify if it's what you’re looking for. Start adjusting the template by utilizing the annotation tools to give your document a more structured and tidy appearance.

In summary, alongside Get Oregon Annual Withholding Tax Reconciliation Report 2019 2020, you'll receive:

With our professional service, your completed documents are typically legally binding and entirely encrypted. We pledge to safeguard your most sensitive information.

Obtain everything needed to create a professional-looking Get Oregon Annual Withholding Tax Reconciliation Report 2019 2020. Make the right choice and explore our program now!

- Insert checkmarks, circles, arrows, and lines.

- Highlight, blackout, and alter the existing text.

- If the document is intended for other individuals as well, you can incorporate fillable fields and share them for others to complete.

- Once you’re finished editing the template, you can obtain the document in any available format or select any sharing or delivery options.

- A comprehensive set of editing and annotation tools.

- A built-in legally-binding eSignature solution.

- The ability to create forms from scratch or based on the pre-uploaded template.

- Compatibility with various platforms and devices for enhanced convenience.

- Multiple options for securing your documents.

- A range of delivery options for easier sharing and dispatching documents.

- Compliance with eSignature regulations governing the use of electronic signatures in online transactions.

To determine if you are exempt from Oregon withholding, review the criteria provided by the Oregon Department of Revenue, which typically includes specific income and residency requirements. If you believe you qualify for exemption, complete the necessary forms and submit them to your employer. Understanding your withholding status is crucial when filing the Oregon Annual Withholding Tax Reconciliation Report 2019.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.