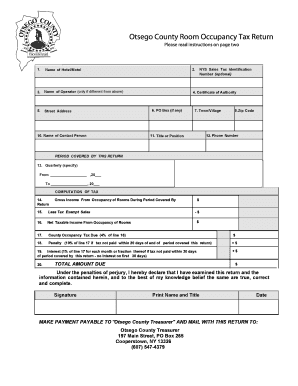

Get Otsego County Room Occupancy Tax Return - Otsego County's ... 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Otsego County Room Occupancy Tax Return online

Filling out the Otsego County Room Occupancy Tax Return online can ensure accurate reporting and compliance with local tax regulations. This guide provides step-by-step instructions to help you complete and submit the form with ease.

Follow the steps to successfully complete your tax return.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the name of the hotel or motel in the designated field. Ensure the name is clearly stated to avoid any confusion.

- If the name of the operator is different from the hotel or motel name, provide it in the appropriate field.

- Fill in the certificate of authority number if applicable, along with the street address.

- If you have a PO Box, enter it in the specified field.

- Provide the name of the contact person who is responsible for the tax return.

- Input the NYS sales tax identification number, which is optional.

- Indicate the town or village where the hotel or motel is located, and then fill in the zip code.

- Enter the phone number of the contact person for further communication.

- Provide the title or position of the contact person.

- In the section labeled 'Period Covered By This Return,' specify the dates for the reporting period.

- In the computation section, enter the gross income from room occupancy for the reporting period.

- Subtract any tax-exempt sales from the gross income to determine the net taxable income.

- Calculate the county occupancy tax, which is 4% of the net taxable income.

- If applicable, include any penalties for late payment, noting the 10% penalty for submitting the return or payment past the deadline.

- Add interest if the tax payment is overdue by more than the specified time, ensuring the correct interest percentage is applied.

- Calculate the total amount due by summing all applicable amounts.

- Review all provided information for accuracy, then sign the document, print your name and title, and date it.

- Prepare your payment addressed to 'Otsego County Treasurer' and ensure it is mailed with the completed return to the designated address.

- Once all fields are completed, you may save changes, download, print, or share the form as required.

Complete your tax returns online today to ensure compliance and timely submissions.

The hotel occupancy tax in Dutchess County is assessed on guests who stay at hotels, motels, or similar establishments. This tax is usually a percentage of the room rate and can significantly impact overall accommodation costs. Understanding this tax is essential for travelers and hotel operators to ensure compliance and proper financial planning. For a seamless experience with the Otsego County Room Occupancy Tax Return - Otsego County's, utilize the resources found on our platform, ensuring you meet all necessary requirements.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.