Loading

Get Irs Form 433 F Mailing Address

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Irs Form 433 F Mailing Address online

This guide provides clear and supportive instructions for completing the Irs Form 433 F Mailing Address online. Whether you are familiar with tax forms or new to them, this step-by-step approach will help ensure that you fill out the form accurately and efficiently.

Follow the steps to fill out the Irs Form 433 F Mailing Address correctly

- Click ‘Get Form’ button to obtain the form and open it for editing.

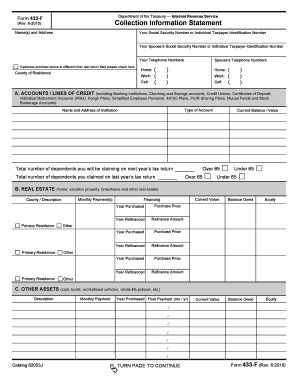

- Begin by entering your name(s) and mailing address in the designated fields. Ensure all information is accurate and up-to-date.

- Input your Social Security Number or Individual Taxpayer Identification Number. If applicable, fill in your spouse’s information as well.

- Fill in the telephone numbers where you can be reached, including home, work, and cell numbers.

- If your mailing address has changed since your last return was filed, check the corresponding box to indicate this.

- In Section A, list all accounts or lines of credit. This includes banking institutions, credit unions, and any type of savings accounts. Report the current balance or value for each account.

- Move to Section B, where you will detail your real estate properties. Fill in information regarding your primary residence along with any additional properties, including current values and balances owed.

- In Section C, note any other assets you possess, such as vehicles or life policies. Provide details like monthly payments and current values.

- Section D requires you to list credit card details, including types, limits, and balances owed.

- Section E involves wage information from you and your spouse. Include employer names and addresses, pay frequencies, and gross income amounts.

- In Section F, detail all non-wage household income. This includes alimony, rental income, and any other income source.

- Section G requests your monthly necessary living expenses. Detail expenses like housing, food, transportation, and any medical costs.

- Finally, in Section H, provide any additional information, including proposed payment amounts and any necessary signatures. Ensure that you have attached any required documentation.

- Once you have completed all sections, save your changes. You may then download, print, or share the completed form as needed.

Start filling out your Irs Form 433 F Mailing Address online today for efficient document management.

IRS Form 433 A is a detailed financial form used by individual taxpayers to provide the IRS with information about their assets and income. It is vital for negotiating payment options for tax debts. If you decide to use this form, ensure you are also aware of the IRS Form 433 F mailing address for any related correspondence.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.