Loading

Get Prsi 52 Week Exemption Application Form 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Prsi 52 Week Exemption Application Form online

This guide provides clear, step-by-step instructions for completing the Prsi 52 Week Exemption Application Form online. Users of all experience levels can follow along to ensure their applications are filled out accurately.

Follow the steps to complete the application form successfully.

- Click ‘Get Form’ button to obtain the form and open it for editing.

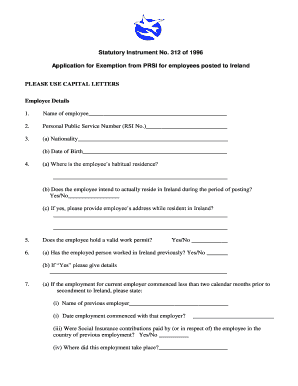

- Begin by filling in the employee details section. Enter the name of the employee in capital letters and their Personal Public Service Number (RSI No.).

- Provide the employee's nationality and date of birth, using the appropriate fields.

- Indicate the employee's habitual residence and specify if they intend to reside in Ireland during the posting. If yes, provide their address in Ireland.

- Answer whether the employee holds a valid work permit by selecting 'Yes' or 'No'.

- State if the employee has previously worked in Ireland. If answered 'Yes', provide additional details as requested.

- If the employment with the current employer started less than two months before the posting, provide the name and start date of the previous employer, along with information regarding social insurance contributions.

- State whether income tax will be remitted to the Irish Revenue Commissioners during the posting period and answer if the employee has been insured in another EEA Member State or with a country that has a Bilateral Agreement with Ireland.

- Complete the foreign employer details, including the country from which the employee is posted, employer's name and address, start date with the current employer, and social security number in the posting state.

- Answer whether the employee has previously claimed the exemption under Article 97 and provide relevant dates and employer information if applicable.

- Fill in the Irish employment details, including the name and address of the Irish employer, commencement date, nature of employment, and expected duration of the posting.

- Indicate whether the employee is taking over from another posted worker and if another worker will replace them at the end of the posting.

- Review your entries for accuracy and ensure that all necessary documents, like a copy of the passport and work permit, are attached.

- Once completed, save your changes, and download or print the form as needed for submission.

Complete your application for the Prsi 52 Week Exemption online today.

It usually takes about 2-4 weeks to receive your Personal Public Service Number (PPSN) in Ireland after applying. This number is essential for accessing many public services, including health and social security benefits. Remember, if you're applying for the Prsi 52 Week Exemption Application Form, having your PPSN ready facilitates the application process.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.