Loading

Get Ks Instructions 2010 K 40 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ks instructions 2010 K 40 form online

Filling out the Ks Instructions 2010 K 40 form online can seem daunting, but with careful attention to detail and step-by-step guidance, you can complete your tax return efficiently and accurately. This comprehensive guide provides user-friendly instructions tailored for individuals with varying levels of experience in tax preparation.

Follow the steps to successfully complete your K-40 form online:

- Press the ‘Get Form’ button to access the Ks instructions 2010 K 40 form, which you can then open in your browser for editing.

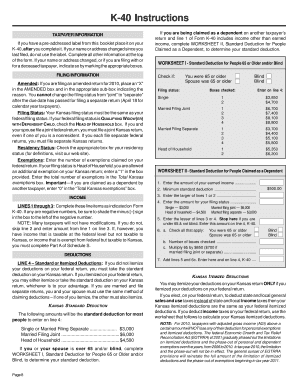

- At the top of the form, provide your taxpayer information. If applicable, affix a pre-addressed label. If your name or address has changed since your last return, do not use the label. Complete all required fields, marking any relevant boxes for special circumstances like deceased taxpayers.

- In the filing information section, indicate if you are filing an amended return by checking the AMENDED box. Note limitations on changing your filing status after the due date.

- Complete the income section by accurately inputting amounts from previous lines. If you're dependent on another taxpayer's return, refer to WORKSHEET II for standard deduction calculations.

- Fill out the deductions section. If you did not itemize deductions federally, take the standard deduction on your Kansas return and refer to the listed amounts for different filing statuses.

- Calculate total exemptions on your return based on your federal exemptions. Be sure to check relevant boxes if filing as Head of Household.

- Proceed to the income lines and report your figures according to the form's guidelines, ensuring to highlight any negative values.

- If applicable, compute tax responsibilities using the specified tax tables for different income levels, distinguishing between resident and nonresident calculations.

- Enter any credits you may be eligible for, such as those for taxes paid to other states. Ensure you retain necessary documentation for these credits.

- Finally, review your entries for accuracy, save your changes, and initiate a download or print of your completed form for your records. You may also share the form electronically if required.

Complete your Ks instructions 2010 K 40 form online today for a smooth tax filing experience!

If you have already mailed your return, or you filed electronically, mail your payment and the voucher to: KANSAS INCOME TAX KANSAS DEPARTMENT OF REVENUE 915 SW HARRISON ST. TOPEKA, KS 66699-1000 Print your name(s), address, Social Security number(s), and the first four letters of your last name in the space provided.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.