Get Form P50 Ireland 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form P50 Ireland online

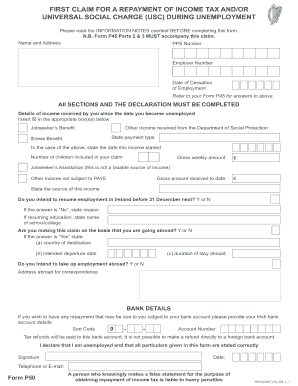

This guide provides clear and supportive instructions for users looking to fill out the Form P50 for a repayment of income tax and/or universal social charge (USC) during unemployment. Whether you are new to digital forms or have experience, these step-by-step instructions will help ensure your application is completed accurately and efficiently.

Follow the steps to complete the Form P50 successfully.

- Click the ‘Get Form’ button to access the Form P50 online. This will allow you to review the form and begin completing it.

- Provide your name and address, and enter your personal public service (PPS) number along with your employer number. These fields are crucial for identifying your claim.

- Indicate the date of cessation of employment in the format D D M M Y Y. This information can be obtained from your Form P45.

- Complete the sections detailing your income since you became unemployed. Mark the applicable boxes for jobseeker’s benefit, illness benefit, or other income received from the Department of Social Protection.

- For each income type, provide the start date of this income, the number of children included in your claim, and the gross weekly amount earned.

- Answer the questions regarding your future employment intentions in Ireland and abroad, including any plans to resume education. Be sure to provide accurate details.

- If applicable, fill out your bank details, including the sort code and account number, where your tax refund should be deposited. Ensure these funds will be paid into an Irish bank account.

- Review the declaration at the end of the form. Check the box to confirm you are unemployed and that all particulars given are correct. Provide your signature and the date.

- After completing the form, save your changes. You can then download, print, or share the completed form as needed.

Complete your Form P50 online today to initiate your tax refund claim.

Yes, you can absolutely do your own tax return in Ireland. Utilizing tools like the Revenue Online Service makes this process much simpler. If you need to claim any refunds, including through Form P50 Ireland, the online platform guides you step-by-step. Remember to have all necessary documents ready to ensure a smooth filing experience.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.