Loading

Get Overdraft Application Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Overdraft Application Form online

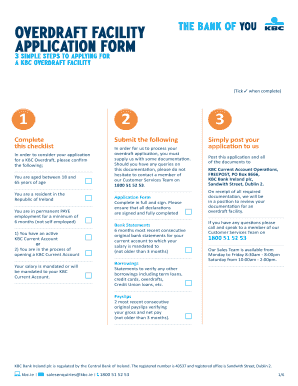

Filling out the Overdraft Application Form online is a vital step in applying for an overdraft facility. This guide will provide you with clear instructions on each section of the form, ensuring that you complete it accurately and submit it correctly.

Follow the steps to successfully complete your application.

- Click ‘Get Form’ button to obtain the form and open it in your browser.

- Review the checklist to ensure that you meet the eligibility criteria. You must confirm that you are aged between 18 and 65, a resident in the Republic of Ireland, in permanent PAYE employment for at least 6 months, and have an active KBC current account or are in the process of opening one.

- Fill in your personal details in the 'Personal Details of Principal Applicant' section. This includes your name, address, contact numbers, and date of birth. Ensure you use block capitals where specified.

- Complete the 'Outstanding Borrowings' section by listing any current loans, credit cards, or mortgages. You will need to provide monthly repayments and lender details.

- In the 'Credit History' section, indicate if you have ever been bankrupt or had court judgments against you. Provide details if required.

- Fill out the 'Savings and Current Account Details' section with information regarding your financial institution and total savings.

- Review the 'Authorisation & Application' section. Confirm that you agree with the terms and conditions and sign where indicated. Ensure you have completed all required fields.

- Once you have filled out all sections, save your changes, and you may choose to download, print, or share the completed form for submission.

Start filling out your Overdraft Application Form online today!

Related links form

Using overdraft correctly involves understanding its terms and using it as a safety net, not as a primary means of funding. Only withdraw funds that you can repay promptly to avoid high fees. Always keep track of your account balance and any transactions to manage your overdraft responsibly.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.