Loading

Get 740 Np Fillable Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 740 Np Fillable Form online

This guide provides a detailed walkthrough for users looking to complete the 740 Np Fillable Form online. Whether you have little legal experience or just need a refresher, this step-by-step instruction will help you navigate through each section with ease.

Follow the steps to fill out the 740 Np Fillable Form online.

- Press the ‘Get Form’ button to access the form and open it in your preferred online editor.

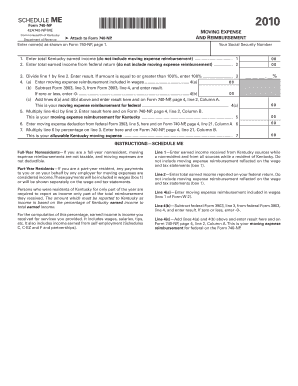

- Begin by entering your name(s) as displayed on the first page of Form 740-NP.

- Locate Line 1 and input your total Kentucky earned income, ensuring not to include any moving expense reimbursement.

- Move to Line 2 and enter your total earned income as reported on your federal return, excluding moving expense reimbursement.

- For Line 3, divide the amount in Line 1 by the amount in Line 2. If the result is 100% or more, enter 100%.

- Complete Line 4(a) by entering the moving expense reimbursement included in your wages as reported in box 1 of your Form W-2.

- For Line 4(b), subtract the amount found in federal Form 3903, line 3, from the amount in line 4 of Form 3903. Enter the result here. If the result is zero or less, enter -0-.

- Calculate Line 4(c) by adding the amounts from lines 4(a) and 4(b). Enter this total on Form 740-NP, page 4, line 2, Column A.

- In Line 5, multiply the amount in Line 4(c) by the percentage calculated in Line 3. Enter this result on Form 740-NP, page 4, line 2, Column B.

- For Line 6, enter the moving expense deduction from your federal Form 3903, line 5. Record this on Form 740-NP, page 4, line 21, Column A.

- Multiply the amount in Line 6 by the percentage shown on Line 3 for Line 7. Enter this amount on Form 740-NP, page 4, line 21, Column B.

- Once all sections are complete, you can save your changes, download, print, or share the form as needed.

Start filling out your documents online today to streamline your filing process.

A Nonresident withholding and Composite Income Tax Return is filed on form 740NP-WH (with copy A of PTE-WH completed for each partner, member, or shareholder) by the 15th day of the fourth month following the close of the tax year. The withholding rate is at the maximum rate provided in KRS 141.020 or KRS 141.040.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.