Get Bir Form 1801 January 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Bir Form 1801 January 2018 online

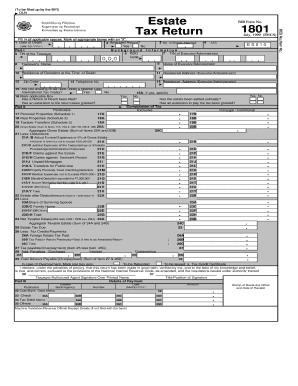

Filling out the Bir Form 1801 is an essential task for individuals responsible for declaring estate taxes. This guide will provide a detailed, step-by-step approach to completing this form online, ensuring a smooth and accurate submission process.

Follow the steps to fill out the Bir Form 1801 online.

- Click the ‘Get Form’ button to obtain the Bir Form 1801 and open it for editing.

- Input the date of death in MM/DD/YYYY format, ensuring accuracy as this is a critical piece of information.

- Specify the number of sheets attached if applicable, to ensure that all relevant documents are submitted.

- Indicate the ATC (Applicable Tax Code) associated with the estate being reported.

- If this is an amended return, mark ‘Yes’ or ‘No’ to indicate the nature of the return.

- Complete Part I by filling out the background information including RDO (Revenue District Office) and Taxpayer Identification Numbers (TIN) of the executor/administrator and the taxpayer.

- Provide the names and addresses of the executor/administrator and the decedent's residence at the time of death.

- State if tax relief is being claimed under special laws or international tax treaties, marking the applicable box.

- In Part II, provide particulars about the estate, including details of personal and real properties, and taxable transfers.

- Calculate the gross estate and applicable deductions, ensuring all calculations are current and accurate.

- Proceed to the computation of the tax due by referencing the estate tax table as appropriate for the net taxable estate.

- At the end of the form, specify any tax credits or payments made, which will affect the total tax payable.

- Sign and provide the printed name of the taxpayer or authorized agent, along with their title or position.

- In the details of payment section, outline the method of payment including any checks or cash provided.

- Review all completed sections of the form for accuracy, then save changes, download, print, or share as necessary.

Complete your Bir Form 1801 online today to ensure compliance and timely submission.

Paying estate tax in the Philippines requires several documents, including the deceased's will, affidavit of self-administration, and proof of property valuation. You will also need to complete the appropriate tax forms and ensure all assets are reported. Thorough preparation can ease this process, and using uslegalforms can help you access necessary documentation, including Bir Form 1801 January 2018 for tax purposes.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.