Loading

Get Form R-1086 - Louisiana Department Of Revenue

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form R-1086 - Louisiana Department Of Revenue online

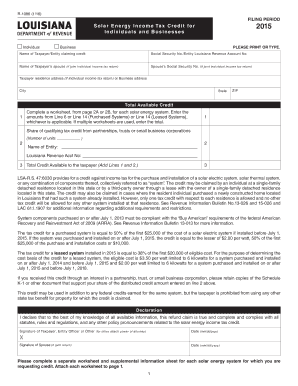

Filling out Form R-1086, which pertains to the Louisiana solar energy income tax credit, can seem daunting. This guide will walk you through each section and field of the form, ensuring that you understand the requirements and can complete it with confidence.

Follow the steps to complete the Form R-1086 online effectively.

- Click ‘Get Form’ button to access the form and open it in the editing interface.

- Begin by filling out the section for the name of the taxpayer or entity claiming the credit. Include the Social Security number or the Louisiana revenue account number.

- If filing jointly, provide the name and Social Security number of the taxpayer’s spouse. Complete the taxpayer residence address or business address fields, including city, state, and ZIP code.

- Calculate your total available credit by completing a worksheet from page 2A or 2B for each solar energy system. Enter the amounts from the appropriate lines based on whether the systems were purchased or leased.

- If applicable, record the share of qualifying tax credit from partnerships, trusts, or small business corporations, and the name of the entity along with its Louisiana revenue account number.

- Sum the amounts from the previous lines to determine the total credit available to the taxpayer. Ensure accuracy to avoid issues with your filing.

- Sign the declaration section, asserting that all information provided is true and complete, and date the form accordingly. If filing jointly, ensure both partners sign and date.

- After completing all required fields, you may save changes, download, print, or share the form as needed.

Complete your Form R-1086 online to take advantage of the solar energy tax credits available to you!

An inventory tax is a property tax applied to a business based on the value of its inventory. It is typically referred to as a business tangible personal property tax (TPP). Inventory tax is based on the state in which you store your inventory, not in the state where your eCommerce business is registered.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.