Get Sc4852

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Sc4852 online

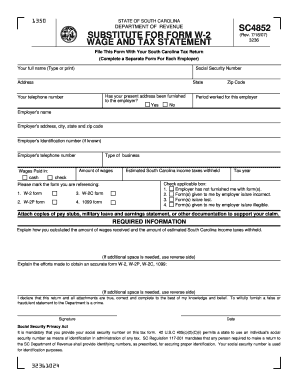

The Sc4852 is a substitute for Form W-2 used for reporting wages and taxes in South Carolina. This guide will provide you with clear, step-by-step instructions to help you complete the form correctly and efficiently online.

Follow the steps to accurately complete the Sc4852 online.

- Click ‘Get Form’ button to obtain the Sc4852 and open it for editing.

- Enter your full name in the designated field.

- Provide your Social Security number in the appropriate section.

- Fill in your address, including state and zip code.

- Indicate whether you have provided your current address to your employer by selecting 'Yes' or 'No.'

- Enter your telephone number in the specified area.

- Specify the period you worked for the employer.

- Write the name of your employer as well as their address, city, state, and zip code.

- If known, include the employer's identification number.

- Fill in the employer's telephone number.

- Indicate if the wages were paid in cash or check.

- Provide the type of business your employer operates.

- Enter the total amount of wages received.

- Estimate the South Carolina income taxes withheld.

- State the tax year for which you are filing.

- Select the appropriate form (W-2, W-2C, W-2P, or 1099) that you are referencing.

- Check the applicable box regarding the status of your employer's form (e.g., not furnished, incorrect, lost, illegible).

- Attach supporting documentation, such as pay stubs or other relevant information.

- In the required information section, explain how you calculated your wages and estimated taxes withheld.

- If needed, provide detailed descriptions regarding efforts made to obtain the correct form.

- Sign the form and date it to affirm the information is accurate.

- Save your changes, then download, print, or share your completed Sc4852 as needed.

Complete your Sc4852 online today to ensure your tax filing is accurate and submitted on time!

Filling out form 4852 involves providing your personal information, including your name, address, and Social Security number. Next, you must explain your wages and tax withheld from the previous year, along with why you need to use this form rather than the standard W-2. This form can be essential for reporting your earnings accurately. Using the guidance and templates provided by US Legal can help clarify steps in completing form 4852.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.