Loading

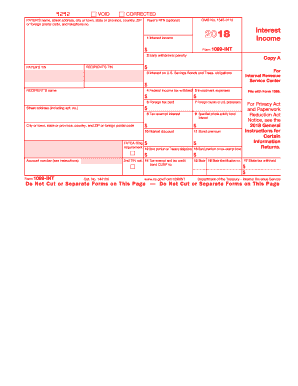

Get How Do I Get A Form 1099 From Opm Faxed 2020-2025

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the How Do I Get A Form 1099 From Opm Faxed online

This guide provides clear and user-friendly steps for obtaining and filling out the Form 1099 from OPM. Whether you are new to tax documents or simply need a refresher, this comprehensive guide will walk you through the process.

Follow the steps to obtain and fill out the Form 1099 from OPM online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the payer's name, street address, city or town, state or province, country, ZIP or foreign postal code in the designated fields.

- Add the payer's federal identification number and, if known, the payer's routing/transit number (RTN). This information helps identify the payer.

- Enter the recipient's name and information, ensuring the recipient's taxpayer identification number is accurate.

- Fill in the various boxes, including the interest income amounts and any applicable penalties or withholdings as per the provided instructions.

- Review all entered information for accuracy, ensuring compliance with IRS requirements. Look for any boxed amounts that pertain specifically to the payer or recipient.

- Once completed, save your changes. The form may then be downloaded, printed, or shared electronically based on your needs.

Complete your documents online promptly and ensure your tax submissions are accurate.

Yes, the income reported on the 1099-R form is generally taxable in New Jersey. This includes distributions from retirement accounts such as pensions and IRAs. It’s essential to report this income correctly to avoid complications with your taxes. If you want clarity on how to handle this, consider tools available through USLegalForms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.