Loading

Get Vat Disclosure Of Errors Form Vat003a.pdf - Saint Lucia Vat

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the VAT Disclosure Of Errors Form Vat003a.pdf - Saint Lucia VAT online

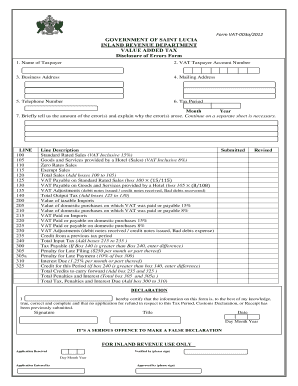

Filling out the VAT Disclosure of Errors Form Vat003a is essential for taxpayers in Saint Lucia who need to report any errors in their VAT submissions. This guide will provide you with detailed, step-by-step instructions to ensure the form is completed accurately and submitted correctly.

Follow the steps to fill out the VAT Disclosure Of Errors Form Vat003a

- Press the ‘Get Form’ button to access the VAT Disclosure Of Errors Form Vat003a. This will allow you to open the document in your editor of choice.

- Enter your name in the 'Name of Taxpayer' field. Ensure that the name matches the official records to avoid discrepancies.

- Input your VAT Taxpayer Account Number in the designated field. This number is crucial for the Inland Revenue Department to identify your account.

- Fill in your business address accurately. This should reflect the official address where your business operates.

- Provide your mailing address if it differs from your business address. This ensures you receive any correspondence related to your VAT.

- List your telephone number to allow for easy communication regarding your submission.

- Specify the tax period by indicating the month and year for which you are reporting the errors.

- In the box provided, briefly describe the amount of the errors and the reasons they occurred. If you need more space, attach a separate sheet.

- Complete the relevant numbered lines related to sales and VAT amounts. This includes filling boxes for standard rated sales, exempt sales, and total sales among others.

- Calculate and enter the total VAT payable and adjustments accurately. Ensure all calculations are verified to prevent further errors.

- If applicable, indicate any penalties for late filing or payment in the corresponding fields.

- Sign and date the declaration section to confirm that the information provided is true and complete.

- Review all entries to ensure accuracy, then save your changes, download, print, or share the form as needed.

Complete your VAT Disclosure Of Errors Form Vat003a online with confidence and accuracy today!

Related links form

The due date for your VAT return can typically be found on your tax authority's website or in your accounting software. Most businesses will receive notifications about upcoming deadlines. Keeping track of these deadlines ensures timely submissions, especially for the VAT Disclosure Of Errors Form Vat003a.pdf - Saint Lucia VAT.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.