Loading

Get Form 16 See Rule 31 1 A

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 16 See Rule 31 1 A online

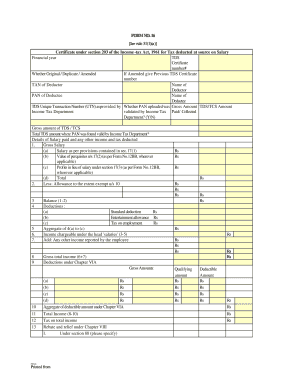

Filling out the Form 16 See Rule 31 1 A is essential for individuals who need to certify the tax deducted at source on their salary. This guide provides clear, step-by-step instructions to assist users in completing the form accurately and effectively.

Follow the steps to complete Form 16 online with ease.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the financial year for which the certificate is issued in the designated field.

- Provide the TDS certificate number. If this is an amended certificate, specify the previous TDS certificate number.

- Fill in the TAN (Tax Deduction and Collection Account Number) of the deductor in the appropriate field.

- Enter the name of the deductor clearly as it appears on official documents.

- Input the PAN (Permanent Account Number) of the deductee in the specified section.

- Complete the name of the deductee in the corresponding field.

- Include the TDS unique transaction number that has been provided by the Income Tax Department.

- Indicate whether the PAN uploaded has been validated by the Income Tax Department by selecting 'Yes' or 'No'.

- Enter the gross amount and the TDS/TCS amount in the respective fields.

- Detail the salary paid and any other income along with the corresponding tax deducted. Follow the structured fields for gross salary, allowances, and deductions.

- Calculate the income chargeable under the head 'salaries' and ensure all figures are accurately reflected.

- After completing all fields related to deductions and rebates, compute the total income and tax payable.

- Finally, ensure to sign the certificate, indicating your capacity and designation, and include the place and date.

- Review all entered data for accuracy. Once satisfied, save changes or download, print, or share the form as required.

Start completing your Form 16 online today!

The 26AS form is a consolidated tax statement that displays the details of tax deducted at source (TDS), tax collected at source (TCS), and other tax-related transactions. This statement helps taxpayers verify their income and tax credits efficiently. It serves as a key document in the tax filing process and relates directly to Form 16 See Rule 31 1 A.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.