Loading

Get 1707 Bir Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 1707 Bir Form online

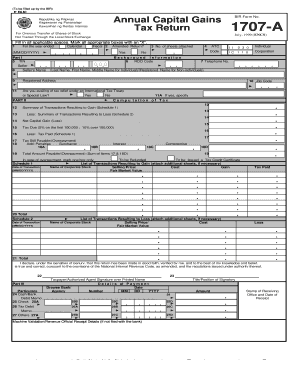

Filling out the 1707 Bir Form online can streamline the process of reporting annual capital gains from the sale of shares of stock not traded on the local stock exchange. This guide provides clear, step-by-step instructions to assist users in navigating the form's components effectively.

Follow the steps to complete the 1707 Bir Form online.

- Click ‘Get Form’ button to obtain the 1707 Bir Form and open it in your preferred editing tool.

- Fill in the applicable sections, beginning with the background information. Provide your Taxpayer Identification Number (TIN) and name as the seller. For individual sellers, include your last name, first name, and middle name. Non-individuals should enter the registered name.

- Input your registered address and telephone number. Also, indicate the Revenue District Office (RDO) code relevant to your tax registration.

- In Part I, select whether you are availing of tax relief under an international tax treaty or special law. If applicable, specify the treaty or law in the appropriate section.

- Next, move to the computation of tax. Begin by summarizing transactions resulting in gains in Schedule 1 and transactions leading to losses in Schedule 2. Ensure to list all transactions with corresponding details, including dates, selling prices, costs, and gains or losses.

- Calculate net capital gain or loss, followed by the tax due based on the prescribed rates (5% on the first PHP 100,000 and 10% on any amount exceeding PHP 100,000). Deduct any taxes already paid to find the tax still payable or overpayment.

- In the case of overpayment, select the appropriate option for a refund or tax credit certificate. Complete the payment details, including the drawee bank information and payment method.

- Sign the form in the designated area, ensuring you date your signature. This declaration is important, as it asserts that the information provided is true and correct to the best of your knowledge.

- Finally, save your changes, and download the form for printing or sharing, if necessary. Make sure to retain a copy of the completed form for your records.

Complete your documents online today to ensure timely and accurate filing.

The BIR inventory list is a documentation requirement where taxpayers must report their inventory levels for a specific tax period. This list is crucial for businesses to accurately reflect their assets and ensure proper taxation. An accurate inventory report complements the information submitted on forms like the 1707 BIR Form as part of the overall tax compliance process.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.