Loading

Get Hmrc Sa400 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Hmrc Sa400 online

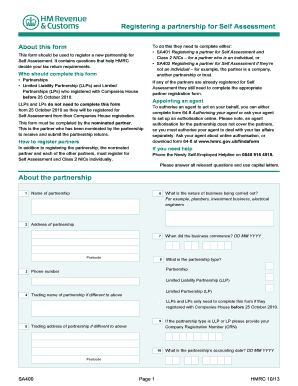

Filling out the Hmrc Sa400 is an essential step for registering a partnership for Self Assessment with HM Revenue and Customs. This guide will provide you with clear, step-by-step instructions to help you complete the form accurately and efficiently.

Follow the steps to complete the Hmrc Sa400 form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Provide the name of the partnership in the designated field. Ensure the name matches the registered business name.

- Enter the address of the partnership, including street, city, and postal code.

- Indicate the nature of the business being conducted, using clear and specific terms such as 'plumbers' or 'investment business'.

- Specify the start date of the business in the DD MM YYYY format.

- Select the type of partnership from the options provided: 'Partnership', 'Limited Liability Partnership (LLP)', or 'Limited Partnership (LP)'.

- If applicable, provide the Company Registration Number (CRN) for LLPs or LPs.

- State the partnership’s accounting date in the same format, DD MM YYYY.

- Enter the name of the nominated partner who will act on behalf of the partnership.

- Fill in the correspondence address of the nominated partner, including postal code.

- If the nominated partner is already registered for Self Assessment, provide their Unique Taxpayer Reference (UTR).

- The nominated partner must sign and date the declaration, confirming the accuracy of the information provided.

- After completing the form, send the SA400 along with any other relevant forms such as SA401, SA402, and 64-8 to the specified HMRC address.

Complete your Hmrc Sa400 online today to ensure your partnership is properly registered.

HMRC typically takes around 10 working days to process self-assessment forms once submitted. However, processing the Hmrc Sa400 can sometimes take longer depending on the period of submission and the complexity of your tax situation. Keeping track of your submission and staying informed can help manage your expectations.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.