Loading

Get Irs Form 1093

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Irs Form 1120-SF online

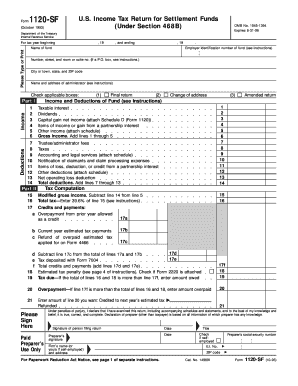

Filling out the Irs Form 1120-SF, the U.S. Income Tax Return for Settlement Funds, can seem daunting. This guide is designed to provide clear, step-by-step instructions to help users complete the form online with ease, ensuring compliance with tax regulations.

Follow the steps to complete the Irs Form 1120-SF online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the tax year at the top of the form, specifying the start and end dates.

- Input the name of the fund in the designated field, followed by the employer identification number (EIN) associated with the fund.

- Provide the address of the fund, including the number, street, and room or suite number, ensuring that if it’s a P.O. box, you follow the specific instructions.

- Next, include the city or town, state, and ZIP code in the appropriate fields.

- Fill in the name and address of the fund’s administrator.

- Check the applicable boxes for income, final return, change of address, or amended return as required.

- Proceed to input information related to income and deductions, detailing items such as taxable interest, dividends, and any other relevant income sources.

- List all deductions in the specified area, and make sure to provide details on items that may require additional schedules.

- Calculate total income and deductions, transferring the required sums to the tax computation section.

- Complete the credits and payments section, entering any overpayments, current year estimated tax payments, and any refunds.

- Sign the form where required, ensuring to include the date and title if applicable.

- Review your entries for accuracy, and when completed, you can save changes, download, print, or share the form as needed.

Start filling out your Irs Form 1120-SF online today for a smooth tax filing experience.

The fastest way to get an IRS form is to visit the IRS website and download the required form directly. You can also use tax preparation services that usually have the forms integrated into their software. If you prefer a physical copy, the IRS can mail forms to you, but this may take longer. Opt for the digital route when you need quick access to IRS documents, like the IRS Form 1093.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.