Loading

Get Bir Form 1701 Editable

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the BIR FORM 1701 Editable online

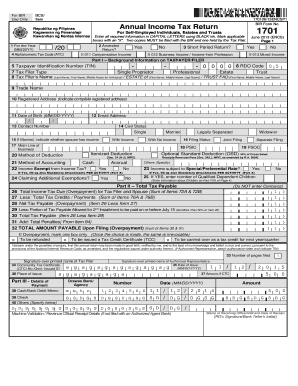

The BIR FORM 1701 Editable is an essential document for self-employed individuals, estates, and trusts to report their annual income tax. This guide will walk you through the process of filling out this form online, ensuring that you understand each section and can complete it accurately.

Follow the steps to complete the BIR FORM 1701 Editable online effectively.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Fill in the year for which you are filing the tax return in the format MM/20YY.

- Select the applicable Alphanumeric Tax Code (ATC) corresponding to your income type from the options provided.

- Indicate whether this is an amended return or a short period return by marking the appropriate box.

- Enter your Taxpayer Identification Number (TIN) and RDO Code in the provided fields.

- Select your Tax Filer Type (e.g., single proprietor, professional, estate, trust).

- Enter your name and registered trade name, followed by your complete registered address.

- Fill in your date of birth, email address, contact number, and civil status.

- If married, specify whether your spouse has income and enter details about your main line of business.

- Proceed to Part II, where you will calculate your total tax payable, income tax due, and any applicable credits or deductions.

- Fill out the tax computation details, including gross sales, other taxable income, and deductions.

- At the end of your form, summarize the total tax amount payable and check the box for any overpayment instructions.

- Finally, review all your entries for accuracy, then save your changes. You can download, print, or share the completed form as needed.

Start filling out your BIR FORM 1701 Editable online today to ensure timely submission!

Printing BIR forms offline involves downloading the required form from the BIR website or a reliable source. Once you have the form, you can open it using a PDF reader and select the print option. Always ensure that your printer settings are correct for optimal results.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.