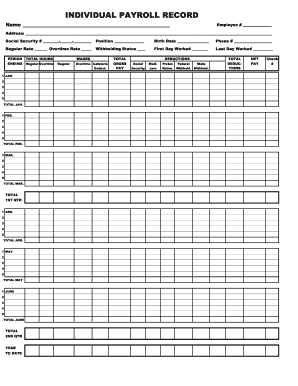

Get Individual Payroll Record 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Individual Payroll Record online

This guide provides a comprehensive overview of filling out the Individual Payroll Record online. By following these detailed steps, you can ensure accurate and efficient documentation of your payroll information.

Follow the steps to complete the Individual Payroll Record online effectively.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your name in the designated field at the top of the form. Ensure that the spelling is accurate, as this will be used for identification purposes.

- Input your employee number in the appropriate section to associate the payroll record with your profile.

- Fill in your address, including street, city, state, and zip code to provide your contact details.

- Enter your Social Security number in the specified format (XXX-XX-XXXX) for taxation and identification purposes.

- State your position or job title to describe your role within the organization.

- Indicate your birth date in the required format to help verify your identity.

- Provide your phone number to ensure you can be contacted if needed.

- Input your regular hourly rate and overtime rate, as applicable, to accurately reflect your compensation.

- Specify your withholding status, which determines tax deductions from your wages.

- Record your first day worked and last day worked in the provided fields to document the employment period.

- Fill in the total hours worked for each week within the designated months, including regular and overtime hours as applicable.

- Calculate and enter the total gross pay, net pay, and total deductions, ensuring all figures are accurate based on the recorded data.

- Review all entries for accuracy and completeness before finalizing the document.

- Once complete, save your changes, and download, print, or share the form as needed for your records.

Start filling out your Individual Payroll Record online to keep your payroll documentation up to date.

ChatGPT is not designed to handle payroll tasks directly, as it cannot access individual payroll records or complete payroll processing. However, it can help answer your questions regarding payroll practices, recommend software solutions, and guide you on best practices. For efficient payroll management, look into dedicated payroll services that can automate and streamline the process for you. Leveraging the right tools ensures accurate handling of your individual payroll records.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.