Get Ol 3 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the OL-3 online

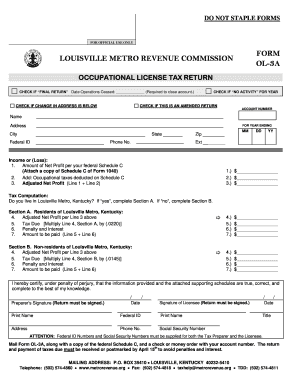

Filling out the OL-3 form online is a straightforward process that ensures compliance with Louisville Metro's occupational tax requirements. This guide provides clear, step-by-step instructions to assist you in completing the form accurately and efficiently.

Follow the steps to fill out the OL-3 form online.

- Click ‘Get Form’ button to access the OL-3 form and open it in the online editor.

- Begin by indicating if this is your final return by checking the appropriate box and entering the date operations ceased, if applicable. If your address has changed, select that option as well.

- Fill in your name, address, account number, city, state, zip code, federal ID, and phone number in the designated fields.

- Provide the relevant year for your income or loss reporting, using the MM/DD/YY format. Fill in your income details as follows: 1) enter the amount of net profit from your federal Schedule C, 2) add any occupational taxes deducted on Schedule C, and 3) calculate your adjusted net profit by summing lines 1 and 2.

- Determine if you reside in Louisville Metro, Kentucky. Based on your answer, proceed to the relevant section: Section A for residents or Section B for non-residents.

- For Section A, residents should take the adjusted net profit from Line 3, calculate the tax due by multiplying by (.0220), and include any penalty and interest to determine the total amount to be paid.

- For Section B, non-residents should similarly fill in the adjusted net profit, calculate the tax due at the rate of (.0145), and include penalties and interest as necessary.

- In the certification section, have the preparer and the licensee sign and date the form. Ensure both parties have provided their federal ID or Social Security number.

- Review all entries for accuracy. Once finalized, save your changes, and download, print, or share the form as needed.

Complete your OL-3 form online today to ensure compliance and avoid penalties.

Anyone earning income within Louisville Metro is subject to local taxes, including residents and non-residents working in the area. Businesses operating in the Metro area also bear tax obligations. It's crucial for both individuals and companies to stay informed about their tax responsibilities to avoid penalties. Utilizing resources such as uslegalforms can help clarify these obligations and keep you compliant.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.