Get Revenue Form K4 42a804 (1109) Kentucky Department Of Revenue Employees Withholding Exemption 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Revenue Form K4 42A804 (1109) Kentucky Department of Revenue Employees Withholding Exemption online

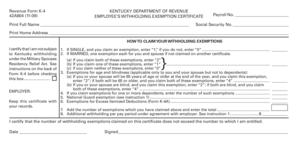

Filling out the Revenue Form K4 42A804 (1109) is essential for employees seeking to claim withholding exemptions in Kentucky. This guide provides clear, step-by-step instructions to help users complete the form online with confidence.

Follow the steps to successfully complete your Revenue Form K4 42A804.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Print your full name in the designated field at the top of the form.

- Enter your payroll number in the appropriate section.

- Input your Social Security number in the specified area.

- Fill in your home address accurately to ensure proper processing.

- Review the section titled 'How to claim your withholding exemptions.'

- If you are single, enter ‘1’ for an exemption or ‘0’ if not claiming.

- Indicate if you or your spouse are 65 years old or older, or if either individual is blind, and mark the appropriate boxes.

- Enter the total number of exemptions claimed, including those for any dependents.

- Provide details regarding any National Guard exemptions if applicable.

- Review any additional regulations concerning itemized deductions and provide the relevant information.

- Add all exemptions from the previous fields and enter the total amount.

- If applicable, specify any additional withholding amount per pay period agreed upon with your employer.

- Sign and date the form at the bottom to certify the accuracy of the information provided.

- Once completed, save your changes, and prepare to download, print, or share the form as needed.

Complete your Revenue Form K4 42A804 online today for efficient processing of your withholding exemptions.

Related links form

To fill out the Form W-4 for exemption from withholding, you need to provide your personal details and indicate your claimed exemption status. It's important to follow the instructions carefully and ensure you're eligible based on your previous tax returns. Utilizing the Revenue Form K4 42A804 (1109) KENTUCKY DEPARTMENT OF REVENUE EMPLOYEES WITHHOLDING EXEMPTION can complement your W-4 submission by formally declaring your exemption from state withholding.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.