Loading

Get City Of Peekskill Transfer Tax Form 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the City Of Peekskill Transfer Tax Form online

Completing the City Of Peekskill Transfer Tax Form online can streamline the process of transferring property ownership. This guide provides clear, step-by-step instructions to help you fill out each section accurately and efficiently.

Follow the steps to complete the form online.

- Click ‘Get Form’ button to obtain the form and open it in your editor.

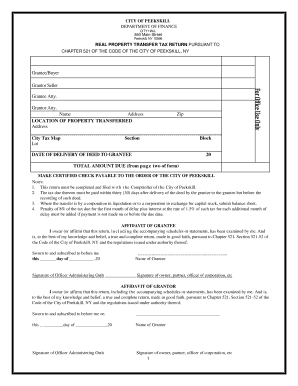

- Enter the name, address, and zip code for the Grantee (buyer), Grantor (seller), and both attorneys in the specified fields.

- Provide the address of the location of the property being transferred, including the tax map page number, section, block, and lot numbers. You can find this information through the City Assessor's office.

- Record the date of delivery of the deed to the Grantee.

- Calculate the total tax due as outlined on the back of the form and enter this amount in the appropriate field.

- Both the Grantee and Grantor must complete their affidavits. If there are multiple Grantors or Grantees, any one of them may sign, but those not signing remain liable for the tax.

- On the second page, enter the date of the contract of sale, which is the date of the last signature on the contract.

- Complete either Section I or Section II based on the property's location, following the specific line-by-line instructions provided.

- Detail the full amount of consideration paid without deductions. This includes all forms of payment, such as cash and non-cash assets.

- Finalize by reviewing all entries for accuracy before saving changes. You can then download, print, or share the form as necessary.

Start filling out the City Of Peekskill Transfer Tax Form online today for a smoother property transfer experience.

Transfer tax in New York is triggered when property changes hands, such as during a sale or other types of transfers. Various exemptions may apply depending on how the transfer occurs, so it’s important to understand the specifics. Utilizing the City Of Peekskill Transfer Tax Form can help clarify these circumstances and ensure that all required taxes are accounted for.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.