Loading

Get Fill In The Balance 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Fill In The Balance online

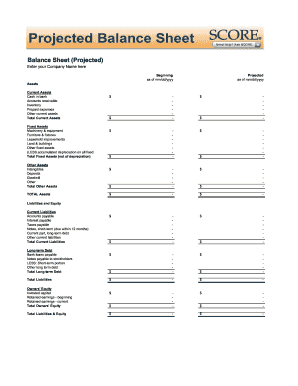

Filling out the Fill In The Balance online can seem daunting, but it is a vital task for projecting your financial standing. This guide provides clear, step-by-step instructions to help you successfully complete the form and make informed financial projections.

Follow the steps to accurately complete the form.

- Begin by pressing the ‘Get Form’ button to obtain the Fill In The Balance form and open it in your preferred online editing tool.

- Enter your company name at the top of the form. Be sure to make it clear and accurate as this will be used in the projection.

- For the 'Beginning' section, input the date in the 'mm/dd/yyyy' format corresponding to your fiscal year start date.

- In the 'Projected' section, fill in the date for when you are projecting your balance sheet, ensuring it is also in 'mm/dd/yyyy' format.

- Move to the 'Assets' section. Start by listing your Current Assets by entering amounts for cash in bank, accounts receivable, inventory, prepaid expenses, and other current assets. Calculate and enter the 'Total Current Assets.'

- Continue to 'Fixed Assets,' where you will itemize machinery & equipment, furniture & fixtures, leasehold improvements, land & buildings, and any other fixed assets. Deduct accumulated depreciation to arrive at 'Total Fixed Assets (net of depreciation)'.

- Next, list 'Other Assets' including intangibles, deposits, goodwill, and any other relevant items. Sum these amounts to determine 'Total Other Assets.'

- Calculate 'Total Assets' by summing up 'Total Current Assets,' 'Total Fixed Assets,' and 'Total Other Assets.'

- Proceed to the 'Liabilities and Equity' section. Start with 'Current Liabilities' and enter amounts for accounts payable, interest payable, taxes payable, and other liabilities before calculating the 'Total Current Liabilities.'

- In the 'Long-term Debt' section, outline any bank loans, notes payable, and other long-term obligations while ensuring to subtract short-term portions as indicated.

- Sum 'Total Liabilities' from both 'Current' and 'Long-term Debt' sections to get a complete view of your obligations.

- Next, enter details in 'Owners' Equity' including invested capital and retained earnings, calculating the total equity.

- Finally, ensure that 'Total Liabilities & Equity' matches the 'Total Assets' to maintain balance. Review your entries for accuracy.

- After completing the form, you have options to save your changes, download, print, or share the document for further review.

Start filling out your Fill In The Balance form online today to gain insights into your financial future.

A balance report is a financial statement that summarizes your business’s assets, liabilities, and equity at a specific point in time. It provides a clear picture of your financial stability. Understanding how to fill in the balance within this report is critical for informed decision-making. Solutions from US Legal Forms make this process straightforward and accurate.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.