Loading

Get Tc 810 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Tc 810 online

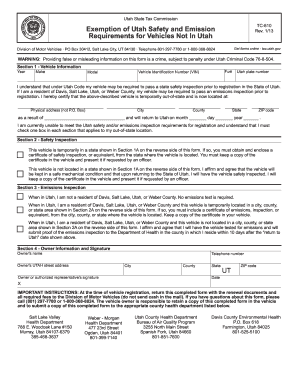

The Tc 810 form is essential for exempting vehicles from Utah's safety and emission requirements while temporarily out of state. This guide provides clear, step-by-step instructions on how to accurately complete the form online, ensuring you meet all necessary guidelines.

Follow the steps to fill out the Tc 810 successfully.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In Section 1, Vehicle Information, provide the year, make, fuel type, Vehicle Identification Number (VIN), model, and Utah plate number of your vehicle. Ensure that the details are accurate and complete.

- Indicate the current physical address where your vehicle is located while it is temporarily out of state. Include the city, state, ZIP code, and county.

- Fill out the reason your vehicle is out of state and the expected return date to Utah. Complete the month, day, and year fields.

- In Section 2, Safety Inspection, indicate whether you will submit a safety inspection certificate if your vehicle is located in a state requiring one. If not located in such a state, affirm that your vehicle will be kept in safe mechanical condition.

- Proceed to Section 3, Emissions Inspection, where you must check the box corresponding to your residency status and emission inspection requirements based on your situation when in Utah.

- Complete Section 4, Owner Information. Enter the owner's name, telephone number, street address, city, county, state, and ZIP code.

- Obtain the signature of the owner or authorized representative, along with the date of signing. Ensure to read the instructions carefully.

- Once completed, save your changes to the form. You can download, print, or share it as necessary. Remember to keep a copy in your vehicle and submit it as required when registering.

Complete your Tc 810 form online today to ensure your vehicle meets Utah’s requirements seamlessly.

The schedule for foreign assets outlines the requirement to disclose various types of foreign-held financial assets when filing your taxes. This schedule includes details such as asset types, values, and acquisition dates. It's important to stay compliant with IRS regulations, particularly if your tax situation is impacted by the Tc 810 code.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.