Loading

Get Form 26g

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 26g online

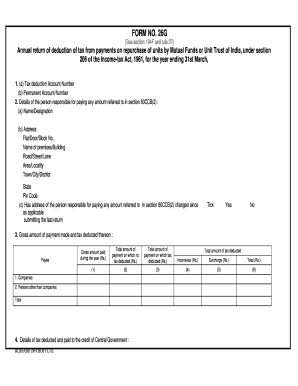

Filling out Form 26g is an essential process for reporting tax deductions related to mutual fund repurchases. This guide provides clear and supportive instructions for completing the form online, ensuring that users understand each step of the process.

Follow the steps to complete Form 26g online.

- Click ‘Get Form’ button to access the form and open it in the editor.

- In section 1, provide your Tax Deduction Account Number and Permanent Account Number. Ensure that these numbers are accurate to prevent any processing issues.

- Section 2 requires you to fill in the details of the person responsible for making the payment. Include their Name/Designation, complete Address, and indicate if their address has changed since their last return by ticking 'Yes' or 'No'.

- In section 3, report the gross amount of payment made and corresponding tax deductions. Fill in fields for total payments on which no tax was deducted, total payments on which tax was deducted, income tax, surcharge, and total amounts.

- Section 4 requires details of tax deducted and paid to the credit of the Central Government. Provide the total amount of tax deducted, including the Sl. No., Challan No., Date of payment, Amount of tax paid, and the Name and address of the bank.

- Complete section 5 for the details of payments made under section 80CCB(2) during the year, providing information for both companies and individual payees. Fill in the required fields such as Permanent Account Number, Name, Amount paid, Date of payment, and tax deduction details.

- Finally, in the verification section, certify the accuracy of the information provided by entering your name, designation, and signature. Also include the date of the certification.

- Once all fields are completed, save the changes to the form, then download, print, or share it as needed.

Complete your Form 26g online today to ensure compliance and accurate reporting of tax deductions.

Getting Form 26A online is straightforward with the right resources. Visit the US Legal Forms platform, where you can search for and download Form 26A instantly. The process is designed to be user-friendly, making it easy for anyone to access the form.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.