Loading

Get 150 101 159

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 150 101 159 online

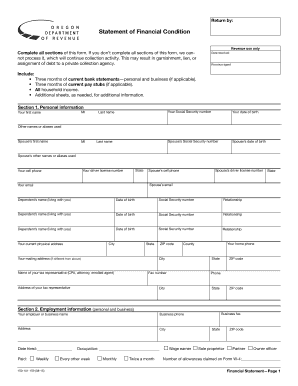

Completing the 150 101 159 form online can be a straightforward process if you follow the appropriate guidelines. This form is crucial for providing your financial information to the relevant authorities, ensuring that your details are processed correctly.

Follow the steps to complete your 150 101 159 form online.

- Press the ‘Get Form’ button to access the form and open it in your preferred digital editor.

- Fill in your personal information in Section 1. Ensure you include your full legal name, Social Security number, and date of birth. If applicable, also provide your spouse's details and the names and details of any dependents.

- Complete Section 2 regarding employment information. Include information about your current employer, job title, and pay frequency (weekly, bi-weekly, monthly, etc.). If you are self-employed, list any co-owners or partners and their responsibilities.

- In Section 3, outline your general financial information, including all bank accounts, assets, and liabilities. Attach the required supporting documents, such as bank statements and vehicle titles, when necessary.

- Proceed to Section 4 and enter your assets and liabilities analysis. Consolidate the totals from previous sections to provide a complete picture of your financial status.

- Section 5 requires a detailed monthly income and expense analysis. List all income sources, including wages, benefits, and any other financial contributions. Don’t forget to document your personal and business expenses accurately.

- If there are any unique circumstances or additional information, use Section 6 to provide this detail. Complete Section 7 by signing the form electronically, confirming that all information is true and complete.

- Once you have finalized your entries, save your changes, download a copy for your records, and be sure to submit the form online as instructed to the appropriate department.

Start filling out your 150 101 159 form online today to ensure your financial information is processed efficiently.

Choosing the correct Oregon tax form depends on your specific tax situation. For most individuals, the 150 series forms are commonly used, including 150 101 159. If you are unsure, visiting the Oregon Department of Revenue's website or using US Legal Forms can provide clarity.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.