Loading

Get Gst Form No No Download Needed Needed

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Gst Form No No Download Needed Needed online

This guide provides clear instructions on how to fill out the Gst Form No No Download Needed Needed online. It is designed for users with varying levels of experience to help you navigate the process with ease.

Follow the steps to complete your application successfully.

- Click ‘Get Form’ button to access the online application and open it in your editor.

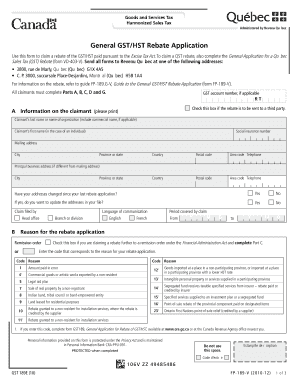

- In Part A, provide your information, including your last name, first name (if applicable), social insurance number, and mailing address. Ensure that all fields are filled accurately.

- Indicate whether your mailing address has changed since your last rebate application and confirm if you wish to update it.

- Specify the period covered by your claim, entering the start and end dates clearly in the provided format.

- Select the reason for your rebate application from the available codes. Make sure to complete any additional required information corresponding to your selected reason.

- In Part C, calculate your total rebate claimed by entering the amounts in the appropriate sections based on your purchases.

- Certify the application by reading and confirming the statements in Part D, then provide your printed name, signature, and date.

- If applicable, complete the section for a third party that you authorize to act on your behalf. Include their information and mailing address.

- In Part F, if you are claiming a rebate through a registered supplier, ensure that this section is filled out by them as required.

- Complete Part G by documenting all purchases on which GST/HST was paid, following the format shown. If more space is needed, attach additional sheets.

- Once all sections are completed, save your changes and choose to download, print, or share the completed form as needed.

Ensure your rebates are processed smoothly by completing your documents online today.

Filing a nil GST return online is a simple process that starts at the GST portal. Log into your account, navigate to the 'Returns' section, and select the appropriate return period. After confirming there are no sales or purchases, submit your nil return, ensuring you maintain compliance and avoid penalties.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.