Get Form 109 B 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 109 B online

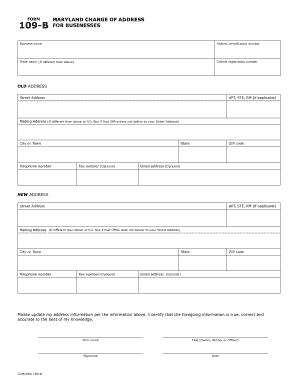

Filling out the Form 109 B is essential for notifying the Comptroller of Maryland about a change in your business mailing address. This guide provides a straightforward approach to completing the form online, ensuring that you provide all necessary details accurately.

Follow the steps to effectively fill out the Form 109 B.

- Click ‘Get Form’ button to obtain the form and open it in your preferred online editor.

- Begin by entering your business name in the designated field. This should match your registration with relevant authorities.

- Input your federal identification number in the following field. Ensure that it is accurate to avoid delays.

- If your business has a trade name different from your business name, include it in the trade name section.

- Next, provide your central registration number, which identifies your business within Maryland's system.

- In the OLD ADDRESS section, fill in your complete old street address. Include any apartment, suite, or room numbers as applicable.

- Add your mailing address if it differs from the OLD ADDRESS, or include a P.O. Box if your post office does not deliver to your street address.

- Complete the city or town field, along with your contact telephone number, state, and ZIP code.

- If desired, you may provide a fax number and email address, although these fields are optional.

- Move on to the NEW ADDRESS section. Here, repeat steps 6 to 9 for your new address information.

- In the certification section, confirm the accuracy of your information. Be sure to print your name, sign the form, indicate your title (such as owner or partner), and include the date.

- Once you have completed the form, save your changes, download a copy for your records, or print the form for submission.

Begin completing the Form 109 B online today to ensure your business address is updated promptly.

Filing Form 109 ICAI typically involves understanding the specific requirements set by the IRS or state tax authorities. Ensure you gather all necessary documentation and follow the outlined instructions for accurate submission. When dealing with tax-related forms like Form 109 B, it’s essential to have everything in order. Platforms like uslegalforms can guide you through the filing process effectively.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.