Loading

Get Missing Receipt Form 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Missing Receipt Form online

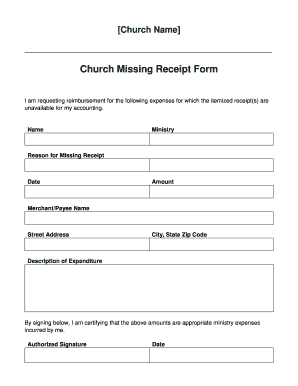

Completing the Missing Receipt Form online is essential for ensuring you receive reimbursement for expenses without receipts. This guide provides clear instructions on each section of the form to help users navigate the process effectively.

Follow the steps to fill out the Missing Receipt Form accurately.

- Press the ‘Get Form’ button to access the document and open it in your preferred editor.

- Begin by entering your name in the designated field. Ensure that you provide your full legal name for identification purposes.

- In the 'Ministry' section, indicate the area or department you are associated with in the church. This helps identify the context of the expense.

- Specify the 'Reason for Missing Receipt' by selecting or summarizing the justification for not having the receipt. Be as clear and concise as possible.

- Enter the date when the expense was incurred. This is crucial for tracking and accounting purposes.

- Input the total 'Amount' that you are requesting reimbursement for. Ensure this matches your expenditure.

- Provide the 'Merchant/Payee Name' where the transaction occurred. This helps verify the expense.

- Fill in the 'Street Address,' 'City, State Zip Code' of the merchant. This information supports the validity of your request.

- In the 'Description of Expenditure' section, give a brief description of what the expense was for, ensuring it aligns with your ministry activities.

- Sign the form in the 'Authorized Signature' section to confirm that the information provided is accurate and reflects appropriate ministry expenses.

- Finally, review all entered information for accuracy. You can then save your changes, download the document, print it, or share it as needed.

Complete your forms online for a streamlined reimbursement process.

To add a missing receipt in Concur, navigate to the expense report section and look for the option to add a receipt. You can then select the Missing Receipt Form as an alternative for documenting your expenses without a physical receipt. Be sure to provide detailed information to support your claim.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.