Get Wv Nrw-4 2010-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

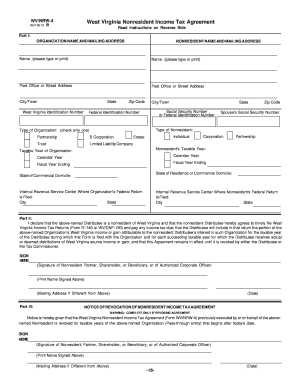

Tips on how to fill out, edit and sign WV NRW-4 online

How to fill out and sign WV NRW-4 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Filling out tax documents can become a major hurdle and a considerable nuisance if accurate assistance is not provided. US Legal Forms has been established as an online solution for WV NRW-4 e-filing and offers many benefits for taxpayers.

Follow these guidelines for completing the WV NRW-4:

Save, download, or export the filled document. Utilize US Legal Forms to ensure quick and simple completion of the WV NRW-4.

- Find the form on the website in the appropriate section or use the Search function.

- Click the orange button to access it and wait for it to load completely.

- Examine the document and follow the directions. If you haven't filled out the form before, follow the step-by-step instructions.

- Pay attention to the yellow fields. They are editable and require specific information. If you are unsure what details to enter, consult the instructions.

- Always sign the WV NRW-4. Use the integrated feature to generate your electronic signature.

- Click on the date field to automatically fill in the current date.

- Review the document to verify and modify it prior to submission.

- Hit the Done button on the top menu once you have completed it.

How to modify Get WV NRW-4 2010: tailor forms online

Experience a seamless and paperless method of modifying Get WV NRW-4 2010. Utilize our reliable online solution and conserve considerable time.

Creating each document, including Get WV NRW-4 2010, from the beginning requires excessive energy, so having a dependable platform with pre-loaded form templates can greatly enhance your productivity.

However, altering them can pose a challenge, particularly with documents in PDF format. Fortunately, our vast library features a built-in editor that enables you to conveniently finish and modify Get WV NRW-4 2010 without having to navigate away from our site, ensuring you don’t squander hours handling your paperwork. Here’s what you can accomplish with your document using our tools:

Whether you require to manage editable Get WV NRW-4 2010 or any other form accessible in our library, you’re on the right track with our online document editor. It's straightforward and secure and doesn’t necessitate any special abilities. Our web-based tool is designed to tackle virtually everything you can imagine regarding file modification and completion.

Stop relying on outdated methods for dealing with your documents. Opt for a professional solution to enhance your operations and make them less reliant on paper.

- Step 1. Locate the required form on our site.

- Step 2. Click Get Form to access it in the editor.

- Step 3. Utilize our specialized editing tools that allow you to insert, delete, annotate, and emphasize or obscure text.

- Step 4. Create and append a legally-binding signature to your document by using the sign feature from the top menu.

- Step 5. If the document’s format doesn’t appear as needed, employ the tools on the right to delete, add more, and rearrange pages.

- Step 6. Insert fillable fields so others can be invited to finish the document (if needed).

- Step 7. Distribute or send the form, print it, or select the format in which you want to download the document.

The standard deduction for West Virginia can change yearly and varies based on your filing status. For most taxpayers, this deduction helps lower your taxable income and can be beneficial when filing your return. Check the latest figures and compare them with other deductions available on your WV NRW-4 for optimal tax planning.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.