Loading

Get Wv It-101v 2009

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the WV IT-101V online

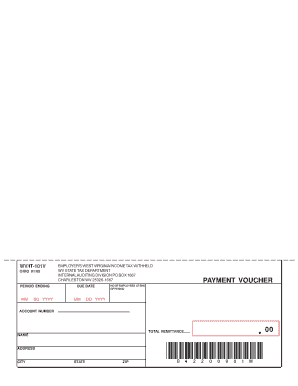

The WV IT-101V form is a vital document for reporting West Virginia income tax withheld by employers. This guide provides clear, step-by-step instructions to help you accurately complete the form online.

Follow the steps to successfully fill out the WV IT-101V online.

- Click ‘Get Form’ button to obtain the WV IT-101V and access it in your preferred browser.

- Enter the period ending date in the format MM/DD/YYYY. This date indicates the last day of the reporting period for which taxes have been withheld.

- Fill in the employer’s West Virginia income tax withheld. Ensure that you accurately report the total tax amount withheld during the period.

- Provide the number of employees at the end of the period. This reflects your workforce size during the reporting duration.

- Complete the account number section. This is typically the account number assigned by the West Virginia state tax department regarding your tax obligations.

- Input your name, address, city, state, and ZIP code accurately to ensure that all information is correctly associated with your filing.

- Review all entries for accuracy. Ensure that all required fields are filled out and that there are no typographical errors.

- Once you have completed the form, you can save your changes. Options typically available include downloading, printing, or sharing the completed form as necessary.

Complete your WV IT-101V form online today to ensure timely and accurate tax reporting.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

To determine if you are not subject to Virginia withholding, review your residency status and income sources. If you primarily earn income in West Virginia, you likely are not subject to Virginia's withholding requirements. Utilizing the WV IT-101V form can help clarify your situation and guide you through the necessary steps.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.