Get Wv Eotc-pit 2012-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the WV EOTC-PIT online

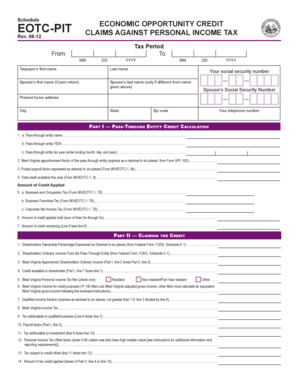

The WV EOTC-PIT form allows users to claim the Economic Opportunity Credit against personal income tax in West Virginia. This guide provides step-by-step instructions to help you successfully complete the form online, ensuring all necessary information is accurately provided.

Follow the steps to complete the WV EOTC-PIT form online easily.

- Press the ‘Get Form’ button to access the form and open it in the editor.

- Enter the tax period dates by filling in the ‘From’ and ‘To’ sections with the month, day, and year.

- Provide your personal information by entering your first name, last name, and if applicable, your spouse’s details.

- Input your and your spouse’s Social Security numbers accurately.

- Fill in your current home address, along with the city, state, and zip code.

- Include your telephone number for contact purposes.

- In Part I, for each pass-through entity, enter the name, FEIN, and tax year, making sure the tax year is complete.

- Calculate and enter the West Virginia apportionment factor of the pass-through entity as a decimal.

- Enter the project payroll factor as a decimal, as specified by the form.

- Record the total credit available for the year according to the previous form.

- Complete the credit applied by filling in the amounts for Business and Occupation Tax, Business Franchise Tax, and Corporate Net Income Tax.

- Calculate the total amount of credit applied by summing the previous fields.

- Determine the amount of credit remaining by subtracting the total credit applied from the total credit available.

- In Part II, input the shareholders' ownership percentage, and their ordinary income from the pass-through entity.

- Calculate the West Virginia apportioned shareholders' ordinary income based on the previous lines.

- Calculate the credit available to a shareholder using the amount of credit remaining.

- Indicate whether you are a resident, non-resident, or part-year resident.

- Calculate your West Virginia income for credit purposes as needed.

- Determine the qualified income fraction as instructed.

- Calculate the tax attributable to qualified business and the tax attributable to investment.

- Determine the personal income tax offset factor; typically, this is 0.80 unless conditions dictate otherwise.

- Find the tax subject to credit offset by calculating the applicable tax attributes.

- Finally, transfer the appropriate amount of tax credit applied to the Personal Income Tax return or any various final steps to save, download, print, or share the completed form.

Complete your WV EOTC-PIT form online today for a smoother filing experience.

To file a non-resident tax return, you should gather all income documents earned in West Virginia. Using the WV EOTC-PIT, complete the appropriate forms, which outline your earnings from that state. You can easily access these forms through platforms like uslegalforms, which provides templates and guidance specifically for non-residents. Filing accurately is crucial to avoid penalties and fulfill your tax responsibilities.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.